PayPal’s Already Turned. The Stock Just Hasn’t. | First Look

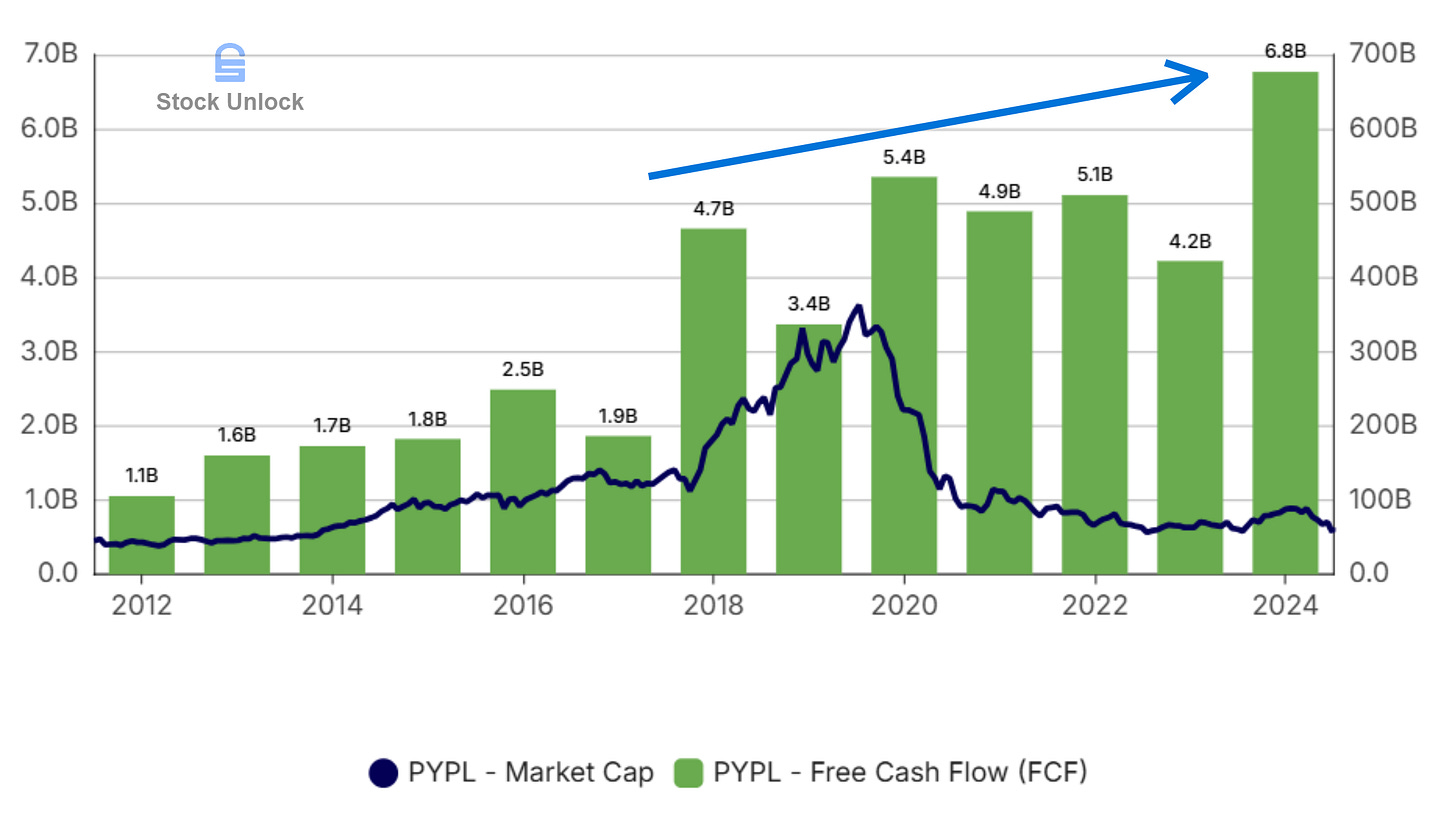

PayPal is trading at 9x free cash flow with a $20B buyback on deck. The turnaround is already here, the stock just hasn’t caught up.

Hey All 👋

Welcome to 📉DeepValue Capital 📈

Every now and then you get lucky.

You find a turnaround stock that’s already turned, and no one has noticed.

That’s PayPal (PYPL) right now.

It’s trading at 9x FCF.

Posting record profitability.

Planning a $20B share buyback.

Still down almost 80% from the highs.

This kind of setup doesn’t come around often.

My portfolio is up 6.5% YTD, 156.56% from Jan 2024 to Mar 2025, and setups like this are a big reason why. (Hint: Paid subscribers get trade alerts, holding spotlights, and full deep dives.)

3 more article you will love!

👉 Intel’s Perfect Storm No One Sees Coming

👉 No One Understands Tariffs or Boeing | Portfolio Update #8

👉 Alibaba Insights and Moves Made | Portfolio Update #7

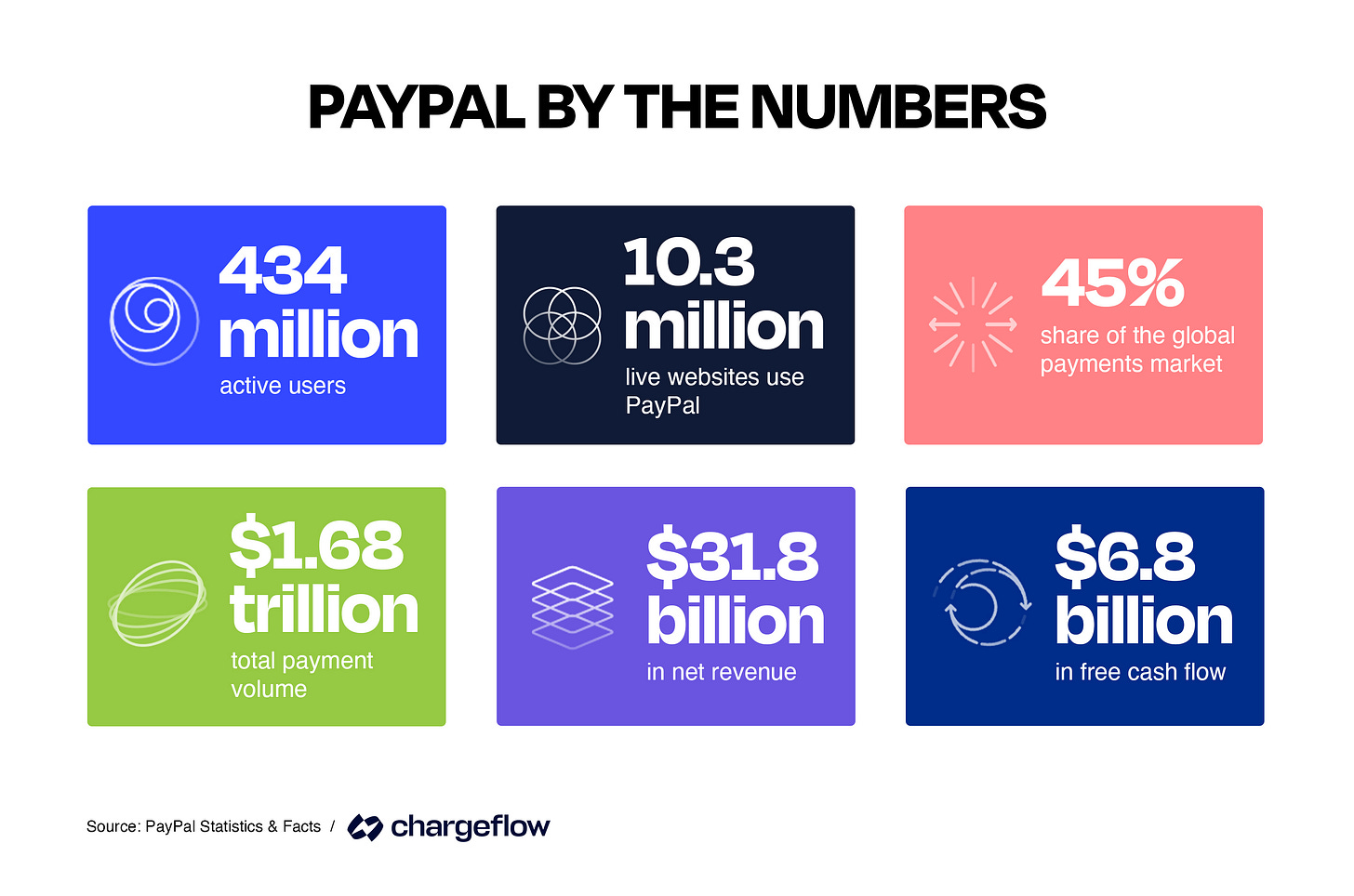

The Business

Ticker: PYPL

Market Cap: $59.91B

Stock Price:$60.56

PayPal is a digital payments platform. It lets users and merchants transact online without sharing financial details. The business breaks into two main segments:

Transaction Revenue: Payment processing, currency conversions, Venmo, Braintree, and Zettle fees

Value-Added Services: Subscriptions for merchant tools, referral and gateway fees, credit services, and interest on balances

PayPal was a COVID darling. Then they became a broken stock, but the core business never went away. And now it’s getting stronger, but no one seems to be watching.

Why It’s Interesting Now

1. It’s stupid cheap

Trading at roughly 9x free cash flow

Generating around $6.76B in FCF

2. Alex Chriss is driving change

New CEO focused on profitable growth

Targeting 20 percent EPS growth per year by 2028

Trimming the fat and refocusing the core. ( Sold non core business and reduced headcount by 9%.)

3. Massive buyback on deck

$20 billion share repurchase plan with $6 billion planned in 2025

That’s about 33 percent of the market cap!

4. Returns on capital are improving

Leaner operations

Better capital allocation

More focus on high-margin revenue

5. Innovation is working

Fastlane is driving 80 percent+ checkout conversion vs industry avg 47%

Merchant adoption looks strong

New features are focused and ROI-driven

Questions I Still Need Answered

This is an interesting opportunity for sure, but I still need clarity on a few key points over the next 3-5 years:

Competition: Can PayPal fend off Stripe, Apple Pay, and other competition?

CEO credibility: Does the experience Chriss has with Intuit transfer well to success with PayPal as a long-term operator?

Catalysts: Beyond FCF growth, what forces the market to reprice this? Or is anything else even needed?

Incentives: Are management incentives aligned with shareholders?

Risks: Are there any major blind spots I’m missing?

Back of a Napkin Valuation

Let’s assume 7 percent revenue growth. That gets them to $39 billion in revenue by 2027.

If they lift FCF margins from 21.4 percent to 24 percent under Chriss, they’ll generate $9.36 billion in FCF.

At just a 16x multiple, that’s a $150 billion market cap.

PayPal today is worth about $59 billion.

That’s over 155% upside in under three years. About a 42% CAGR. And that doesn’t even include the effects of the buyback!

If PayPal doesn’t look interesting right now I just don’t know what else to say.

Liked this article? Hit that subscribe

Disclaimer:

This content is provided for informational and entertainment purposes only and should not be construed as professional financial or investment advice. The opinions expressed herein are solely those of the author, based on personal research and analysis, and do not reflect the views or advice of any financial institutions or licensed professionals. I do not have access to your personal financial situation, goals, risk tolerance, or investment preferences, and therefore cannot provide personalized investment recommendations. It is essential that you conduct your own research, carefully consider all relevant factors, and consult with a licensed financial advisor or other professional before making any investment decisions. Investing inherently involves risk, including the potential loss of principal, and past performance is not indicative of future results. I am not responsible for any decisions, actions, or outcomes resulting from the use of this content. Always ensure that your investments align with your personal financial situation and long-term objectives.

Ok, so it’s considered ‘cheap’ based on valuations and some assumptions on decent growth - they went up already a bit since the beginning of April. Did you already open a position / what would be a good entry price for you? Thanks in advance.

Sell-side is guiding for 5/6% revenue growth, and decreasing FCF conversion. Also, I think they face sizeable competition risk from Stripe (for B2B) and Apple Pay (for C2C).