Hey All 👋

Welcome to 📉 DeepValue Capital 📈

Everyone thinks they understand how import tariffs will play out and have written off Boeing as a dead relic. They are wrong.

Get that along with an update on portfolio performance, holdings, and buys and sells in this weeks portfolio update.

YTD my portfolio has returned about -0.2% and from 1/1/2024 to 3/31/2025 is up 156.56%. Crushing the markets.

ANNOUNCEMENT: Starting today I will be posting live trade updates in my subscriber chat. See you there!

3 more articles you will love!

Investors often miss long-term gains by focusing on short-term noise. My strategy targeting turnaround deep value companies has led to market-beating returns and can help you too. (Hint: Paid subscribers get access to the best content like portfolio access, trade updates, and deep dives.)

The Future of Tariffs 📜

This is a special section only included this week to share some of my thoughts on tariffs.

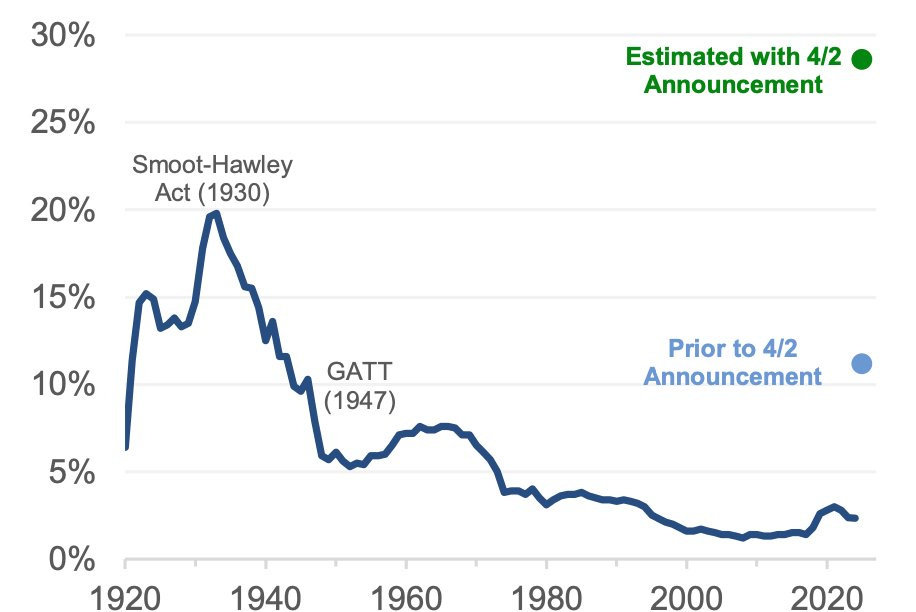

To preface I should make it clear no one knows what will happen with tariffs. While the tariffs in the 1930’s might be useful in some ways in others they are not at all.

In the 1930’s the US was in the early stages of the great depression with unemployment rising and banks failing. Now we are at historically low unemployment and consumers continue to increase their spending.

These are two completely different economic starting points with a more integrated world economy.

No one knows what will happen regardless of the length of time tariffs stay in place.

With that out of the way let me give you my slightly deeper thoughts that will almost certainly be wrong.

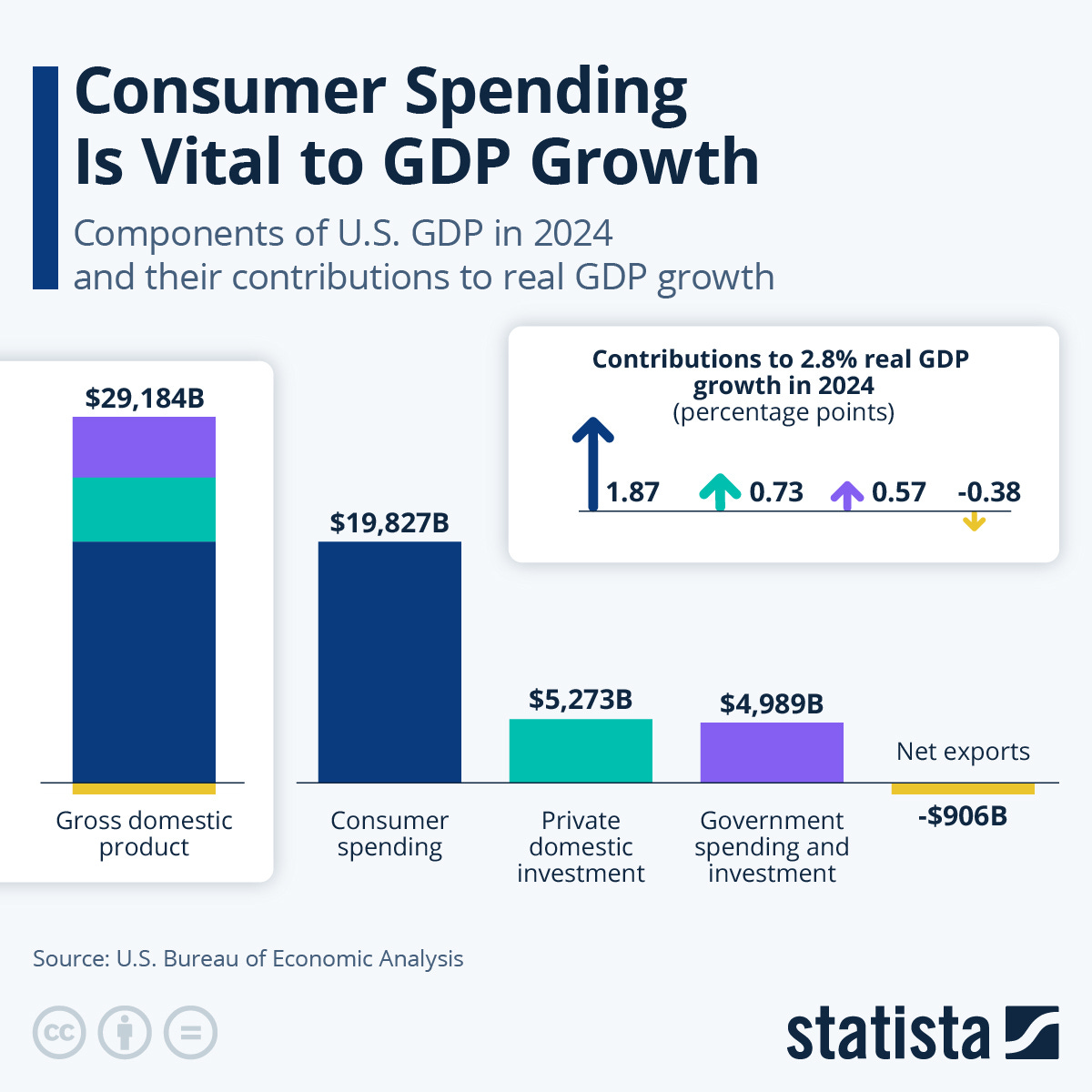

I think generally people are underestimating how important US consumer’s are to the rest of the world. We spend almost $4T on foreign goods each year.

If our demand for global goods falls, it could send countries into a deflationary cycle. This looms as a massive incentive to cut deals with Trump.

Exactly what kind of deals Trump wants to make is unclear to me. Other than he wants to lower deficits, and bring capital back to the US. Or at least send it abroad slower.

During this period of deal cutting it is likely the worlds demand for America’s goods falls. This brings to light what I would consider a silver lining.

US farmers would need to sell more back to the US and would lower grocery prices.

If deals are not struck this could turn into a deadly game of chicken with a trade war. It would cause massive supply chain issues and likely force us into a recession.

How mild or severe that would be, I don’t know.

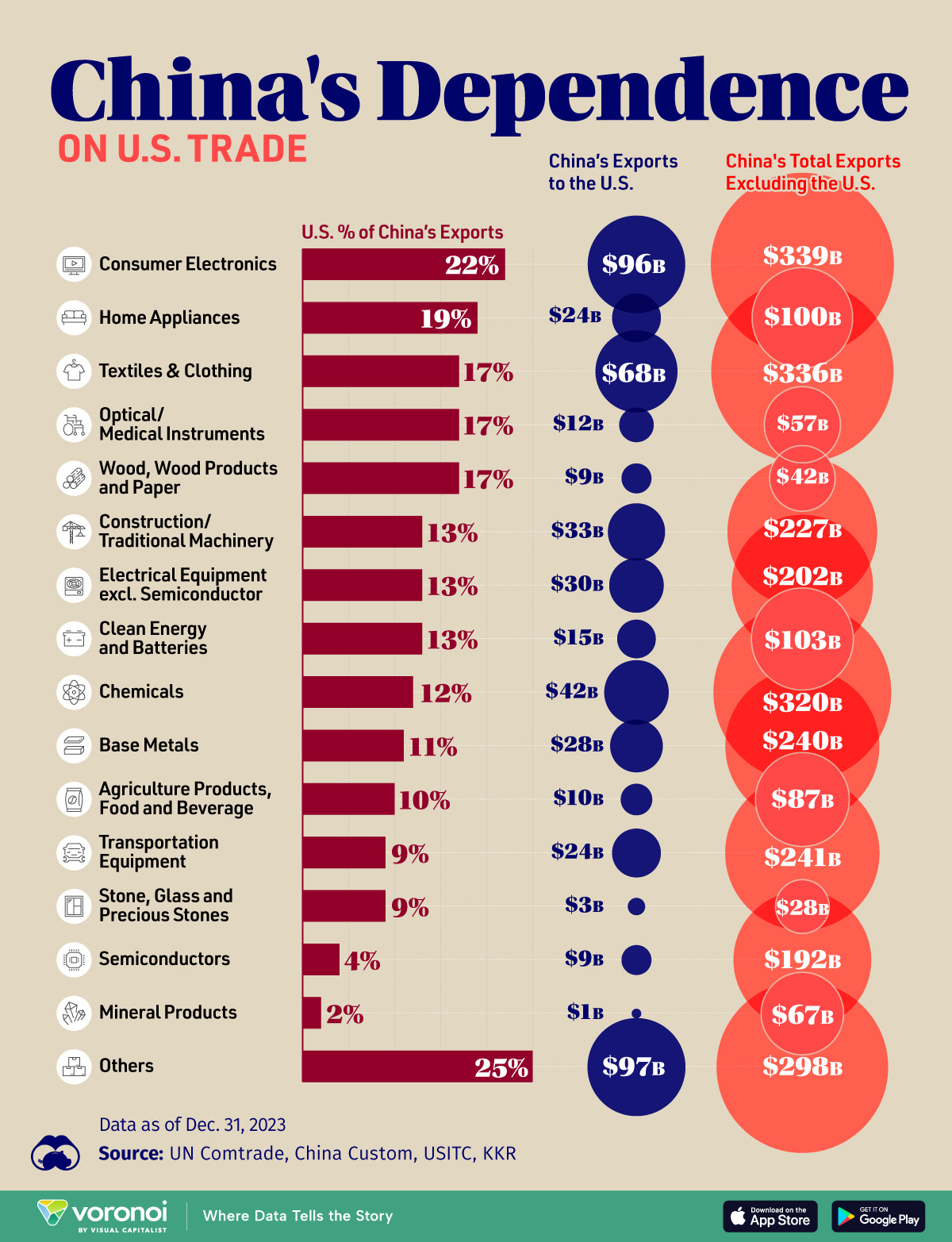

The most worrying country in this whole situation is China. They continue to state they will “fight to the end”.1 They do not want to lose. And capitulating to Trump in there minds would likely be considered losing. How things will play out with them is even more unclear.

It could even be tariffs remain on most countries to prevent China from shipping goods to them and then from there onto us to avoid a tariff. China not stepping forward to make a deal is likely the most likely risk. Though even China relies heavily on the US consumer.

I do believe however that we will see deals made and relatively quickly with countries other than China.

Almost immediately after the tariff announcement Vietnam and Cambodia came forward to negotiate.2 And over the weekend there were reports over 50 countries were banging down Trumps door to get a deal done.3

Once negotiations start rolling those first countries will see demand rise significantly. As the goods without the tariffs become comparably cheaper to those that have not cut a deal. This puts more pressure on those countries that have not done a deal to come to the table.

Take everything with a massive grain of salt. I am not an economist and never will be. This is merely my thoughts on something affecting every investor.

Below are some resources I felt did a good job explaining the situation in a much better and more clear way than I could.

I highly recommend checking out

and his article covering tariffs and our current situation.Performance & Portfolio 📈

2025 has been another phenomenal year with market crushing returns. Of course this is only the second example year. Outperformance is earned over the long run and bear markets. Still though I am very happy with how things have gone.

2024 Returns: 85.23%1

2025 (Through March) Returns: 38.51%

Obviously the first week of April has been pretty turbulent but even with the blood in the water I am only down about -0.2% YTD.

Now lets jump into the holdings across my personal and client portfolios.

Keep reading with a 7-day free trial

Subscribe to DeepValue Capital to keep reading this post and get 7 days of free access to the full post archives.