Intel's Perfect Storm No One Sees Coming | First Look

It is hard to find a tech company more hated than Intel right now. But right under everyone's nose they are positioned to ride a wave that will bring the company back to its former glory.

Hey All 👋

Welcome to 📉 DeepValue Capital 📈

Intel is sitting right in the middle of a massive shift to AI inference, tariffs, and huge infrastructure investments. And their new CEO is an expert in taking advantage of secular tailwinds.

3 More articles you will love!

Investors often miss long-term gains by focusing on short-term noise. My strategy of targeting turnaround deep value companies has led to market-beating returns this year, and it can help you do the same. (Hint: Paid subscribers get access to the best content.)

Ticker: INTC

Market Cap: $97.81B

Stock Price: $22.43

The Business

Intel is a global semiconductor company powering much of today's digital infrastructure. They break their business into five key divisions:

Client Computing Group: Creates processors for personal computers and laptops

Data Center and AI: Powers cloud computing and enterprise AI infrastructure

Network and Edge: Enables telecommunications networks and IoT connectivity

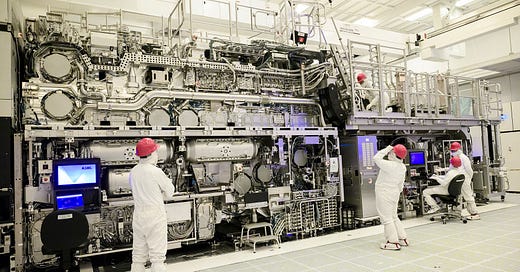

Intel Foundry: Manufactures semiconductors for other technology companies

Other

Altera: Develops programmable chips for specialized industries

Mobileye: Creates autonomous driving and driver technologies

Their products and services are for a wide variety of customers:

Consumer Tech: Powers devices from PC brands like Dell, HP, and Lenovo.

Cloud Infrastructure: Supports platforms like AWS, Microsoft, and Google Cloud.

Industrial Applications: Enables smart technologies in manufacturing and healthcare.

Automotive Industry: Delivers driving systems through Mobileye.

Why are they interesting?

Intel is sitting right in the middle of a massive shift to AI inference, tariffs, and huge infrastructure investments. And their new CEO is an expert in taking advantage of secular tailwinds.

And these are only part of why I like the company!

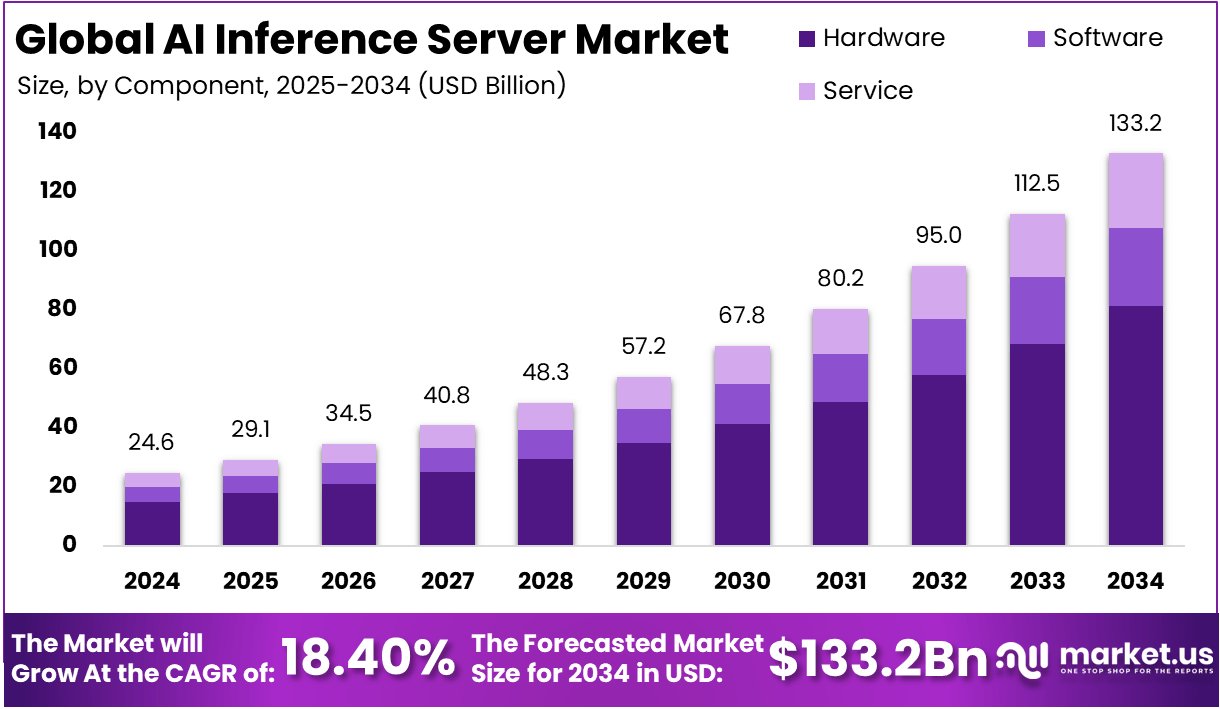

As AI shifts from training to actually being used to solve problems the change is from the most powerful chips to those that are cheap and efficient. In other words Intel’s game.1

Large tariffs were announces on 4/2/25 across almost every industry and many countries. While semiconductors were excluded for now this will spook both TSM from building fabs outside the US. Which they are many years out from finishing. And push companies in the US to sourcing at home.

During Covid the US recognized that we are completely reliant on foreign companies for one of the most crucial supplies. Chips. So they decided to give Intel $7.86B in grants to build foundries. Of which $5.66B is still on its way.

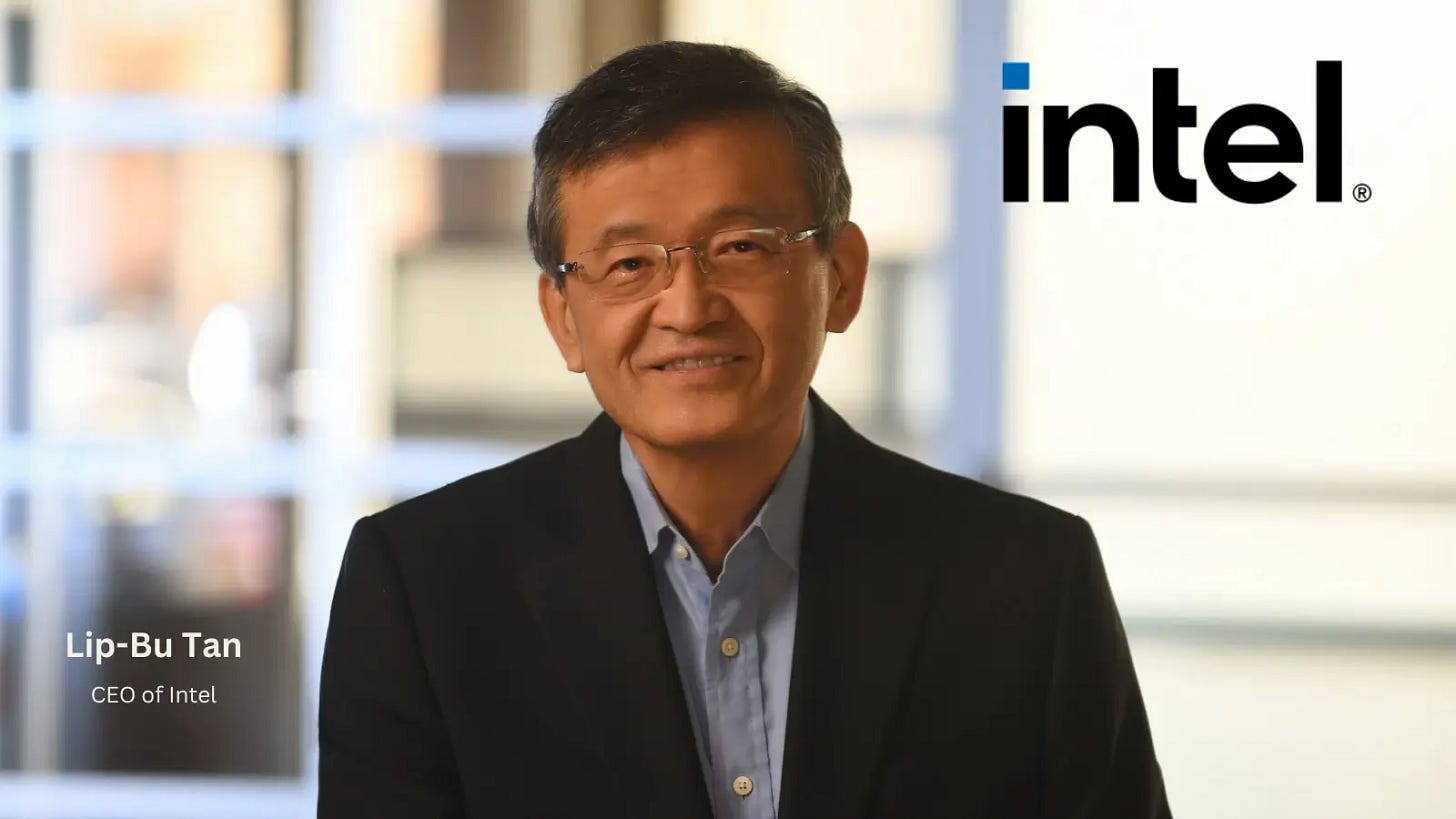

Their new CEO Lip-Bu Tan comes from Cadence Design Systems. During his 12 years as CEO he turned the business around after 2008. Grew revenue by 180%. And delivered returns of 3,200% to shareholders. No small feat!

A massive amount of PC’s were bought during Covid. Those PC’s are getting old and need replaced which will drive a PC refresh cycle.

To compliment the refresh cycle AI is rapidly integrating into PC’s making the new PC’s more useful.

On a normalized 19% median FCF margin from the last 30 years for the company they are trading at about 9x FCF. On revenue that is down 31% since 2021. (Which, driven by the PC refresh cycle. A transition to inference for AI. And foundry demand will go above all time highs.)

Intel stock is down almost 70% from 2021 highs.

As I wrote all of these out I realized how interesting Intel really is looking at current levels!

Don’t get me wrong here Intel has had its issues. Spending 10’s of billions on foundries that are not profitable yet. Losing market share to AMD. And excessive bloat and costs pulling profits down even further.

These are real issues but ones I believe are starting to be taken care of in real time.

Foundries are starting volume production in 2025. With rumors circulating that chip designers are eager to start producing when they are up.

Intel plans to cut $10B in costs by the end of 2025.

Their new 18A chip is best in class on performance per watt and efficiency.

There are still many things that need executed on. But with their new CEO they are poised to have a monster few years after everyone has already written them off.

Below are the places deeper work is needed before Intel could become a position for me.

How will the PC refresh cycle play out and what that would mean for Intel?

Are management incentives aligned with shareholders?

What specific risks does Intel face in getting back to growth and all time high revenues?

These are big questions but if I can get clear on these Intel may be worth adding to the portfolio.

Quick Valuation

My base case as of right now is Intel reaching $100B in revenue by year end 2030 with 20% FCF margins.2 If they achieve their median multiple of 17x this assumes a market cap of $340B or about a 3.5x in 4 1/2 years.

This would achieve a 27% CAGR on reasonable assumptions given the tailwinds at the company’s back.

Forbid they blow them out of the water and get to $115B in revenue on a 21% margin and 20x multiple. You would then see about a 5x in the same time frame.

Either way Intel has a bright future building out in the US. And the government seems behind them to make that happen.

Liked this article? Hit subscribe.

Disclaimer:

This content is provided for informational and entertainment purposes only and should not be construed as professional financial or investment advice. The opinions expressed herein are solely those of the author, based on personal research and analysis, and do not reflect the views or advice of any financial institutions or licensed professionals. I do not have access to your personal financial situation, goals, risk tolerance, or investment preferences, and therefore cannot provide personalized investment recommendations. It is essential that you conduct your own research, carefully consider all relevant factors, and consult with a licensed financial advisor or other professional before making any investment decisions. Investing inherently involves risk, including the potential loss of principal, and past performance is not indicative of future results. I am not responsible for any decisions, actions, or outcomes resulting from the use of this content. Always ensure that your investments align with your personal financial situation and long-term objectives.

https://market.us/report/ai-inference-server-market/

Based on marginally higher than current PC and other product sales along with hitting their goal of $40B in fab revenue by 2030.

Loved this article, super concise and has definitely peaked my interest into Intel, especially after the change of CEO! You got yourself a new subscriber! Would love to collaborate on a deep dive into Intel if that is something that would interest you!