Fresh Stock Picks & Weekly Insights: Drive, Dive, and Survive Edition

Digging Into Owens & Minor ($OMI), Revisiting Leslie ($LESL), and Tracking Cooper Standard's Progress($CPS)

Welcome to DeepValue Capital by Kyler!

I write in depth reports on unloved and undervalued companies that are turning things around. With the aim of 30% average annual returns.

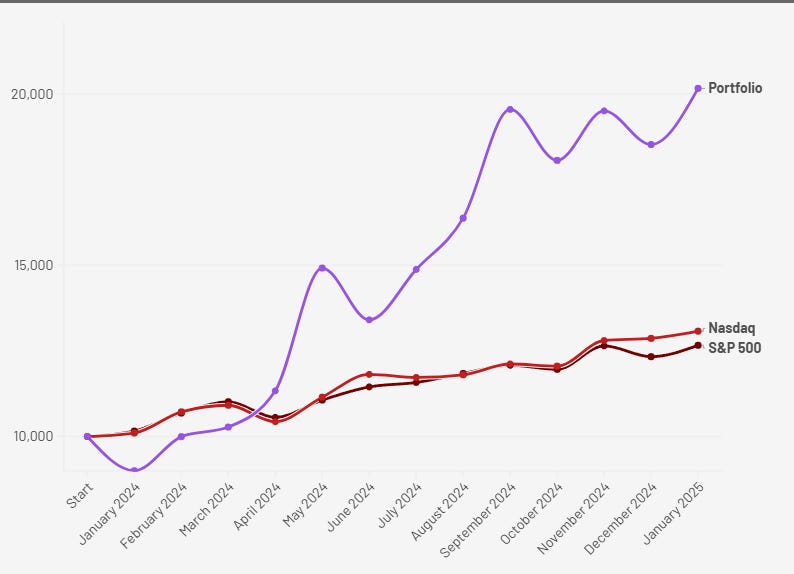

From January 1, 2024, to January 31, 2025 my portfolio has delivered returns of 101.62% and I did that despite making mistakes along the way.

I bought companies I shouldn’t have. I made impulsive decisions. I incorrectly sized positions. My goal is 30% returns but it is not a guarantee.

However I can guarantee I will work relentlessly to make smart decisions, keep learning, and provide that research to you.

Now, let us dive into the latest research and opportunities I'm exploring.

Fresh Opportunity: New Stock Idea

Owens & Minor-($OMI)

OMI is boring company presenting a not so boring opportunity. First lets take a look at a segment breakdown so you know what the company does.

About 75% of their revenue comes from manufacturing healthcare supplies. Things like scalpels, bandages, sterilization containers, and wheel chairs.

The other 25% comes from their patient direct services. Which includes things like setup, education, and support using their manufactured goods.

Why is OMI Interesting?

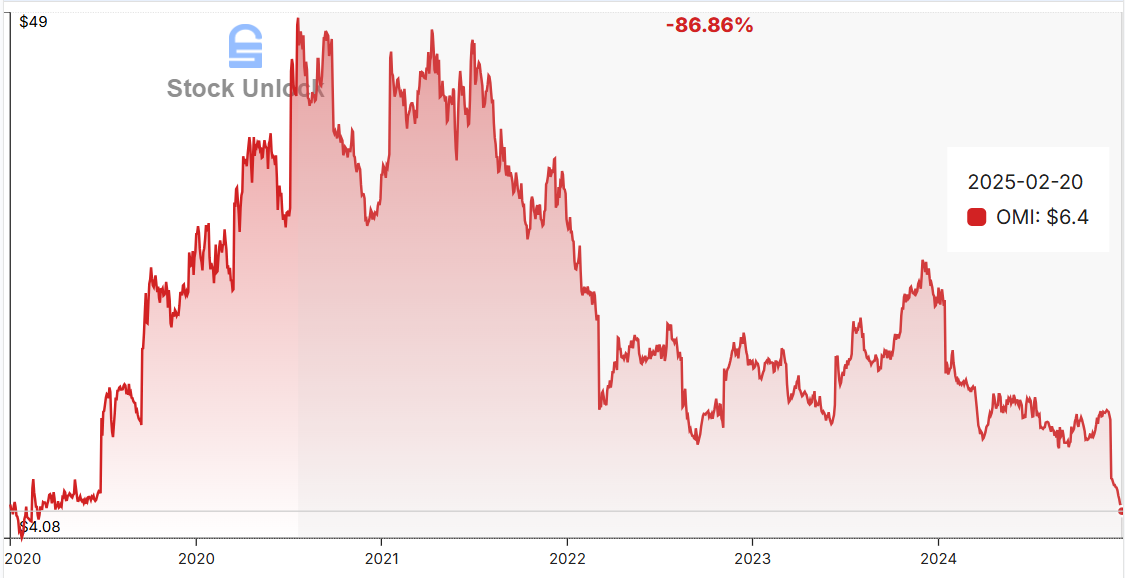

Stock is down 87% from 2020 highs

Shows high operating leverage (trading at 0.05x sales)

10.5% ROIC and 13.5% ROCE since 1990

Revenue at all-time highs

Experienced leadership: CEO's 15-year tenure at Thermo Fisher saw 10x stock growth

U.S. manufacturing advantage due to tariffs

What Am I Researching?

I am focused on whether OMI can turn margins around quick enough to pay down debt. They're sitting on $1.9B in long-term debt, with another $1.36B coming in early 2025 from their Rotech acquisition.

My research plan includes analyzing the following. Earnings call transcripts, understanding the Rotech business, and identifying potential growth catalysts.

My Current Take

OMI is very cheap any metric you choose If there is a catalyst that improves margins, the stock could rerate quickly.

However, I expect some challenges in 2025.The Rotech acquisition likely won't be smooth sailing. Which could lead to a temporary drop in free cash flow and possible solvency concerns. This short-term pressure might create an opportunity to buy at lower prices. My take at the moment is I'm likely early, but the potential upside is worth watching.

To really hammer home why they are worth watching lets do a back of the napkin valuation.

Here's what the numbers could look like by 2027: With 8% revenue growth at OMI plus flat Rotech revenue, we'd see $12.26B in total revenue. At a 1.5% free cash flow margin, this generates $184M in FCF. Apply a reasonable 10x FCF multiple, and the market cap reaches $1.85B. A potential 260% return in under 3 years.

While this is rough math, it shows why OMI is worth deeper research.

Update on Last Week’s Pick

Leslie - ($LESL)

Below are the questions I focused on in my continued research so lets see what I found!

My first thought researching Leslie’s plan went to Charlie Mungers famous quote.

In reviewing Leslie's recent DEF 14A filing, I found that management pay consists of two bonus structures:

Short-term cash bonuses tied to EBITA maximization

Stock-based bonuses awarded based on two key metrics over a 2-year period:

Cumulative revenue targets

Cumulative adjusted net income levels

These aren't the focused incentives I would prefer. But for management to hit these targets, they'll need to improve operations significantly. Which is a positive sign.

Now onto Leslie's turnaround plan. For now, they are focusing on two key objectives:

Inventory management and optimization

Rolling out higher margin pro services to more stores

These changes will take time to show results but could be meaningful if executed correctly. On the leadership front, Leslie recently brought in a new CEO, Jason McDonell. His background? He served as Executive Vice President at Advanced Auto Parts from 2019 to 2023.

If you know AAP's history, you know they've struggled. They've gone through major restructuring. And it's not a good sign that Leslie's new CEO comes from their top leadership during this troubled period.

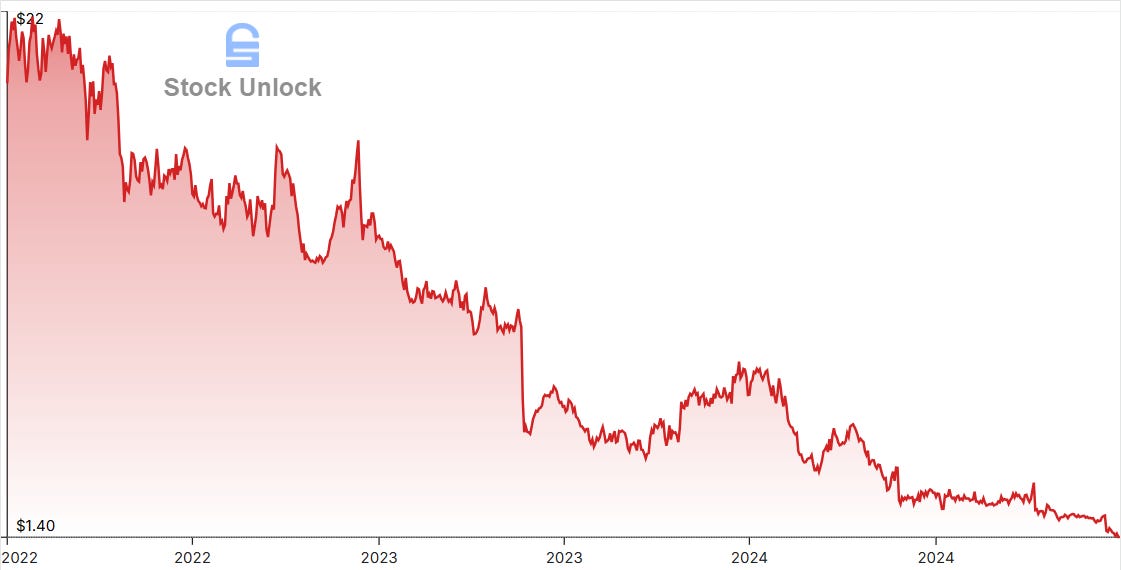

After analyzing everything, I can confidently say Leslie is a pass for now. Even if they hit peak cash flow by 2026, they'll still face debt 5x larger that must be paid within 2 years.

Three major challenges stand in their way:

Need to restructure massive debt quickly

No proof yet that the turnaround is working

Leadership from a struggling company

I'll check back at the end of 2025 to see if there are positive signs, but right now, there are too many unknowns for me.

What do you think of the company?

As I completed this research, I noticed similar challenges between Leslie and Cooper Standard (my 2nd largest holding). Here's a quick comparison of why I like CPS but not LESL right now:

Key Similarities:

Both companies faced major debt issues

Both experienced significant margin declines and revenue drops that threatened debt payments

Key Differences:

Cooper Standard started cutting costs earlier and more aggressively

Cooper Standard has higher operating leverage ($2.7B in revenue vs Leslie at $1.33B)

Cooper Standard shows more signs of recovery in volume and profits

Cooper Standard's debt is spread out over several years while Leslie's is due all at once

Cooper Standard trades at a much lower valuation on both price-to-sales and free cash flow metrics

The bottom line is these distinctions are crucial. They may seem small but, they're the difference between needing many things to go right versus just a couple.

Portfolio Spotlight

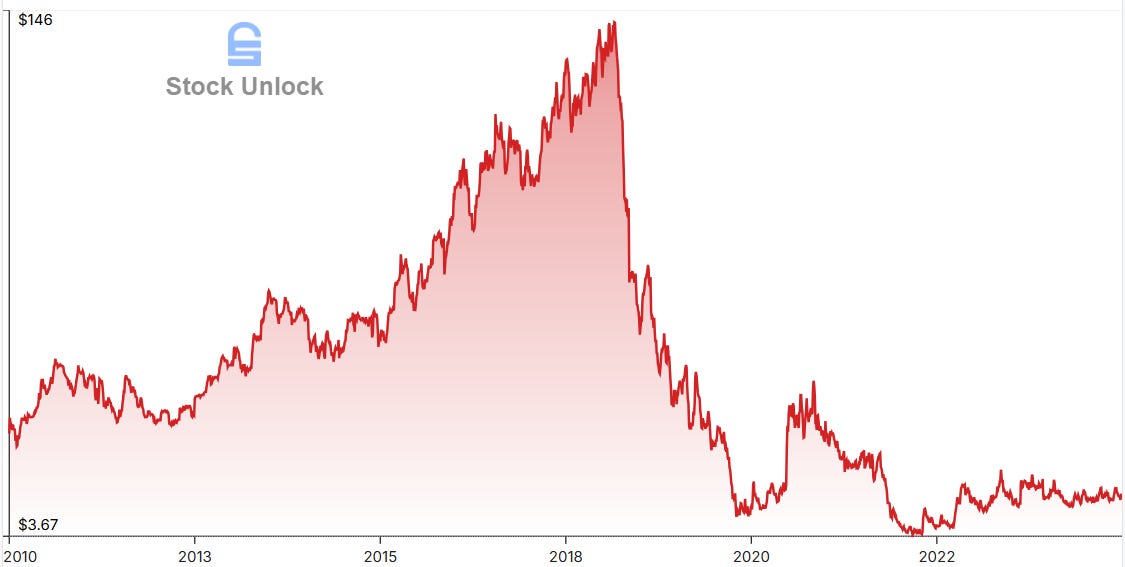

Cooper Standard-($CPS Write Up Here)

Resources:

I have to give credit to Tom Hayes of Hedge Fund Tips. I cannot recommend his work highly enough. This position and much of my analysis comes from his insights. He's producing outstanding research that you can find on YouTube, Spotify, or his Substack. If you're serious about investing, his content is a must follow.

2/14/25 Cooper Standard released Q4 and full year 2024 earnings.

Fourth Quarter 2024 Summary

Sales totaled $660.8 million, a decrease of 1.9% vs. the fourth quarter 2023

Net income of $40.2 million, or $2.24 per diluted share, reflected an improvement of $95.4 million vs. the fourth quarter of 2023

Net cash provided by operating activities of $74.7 million and free cash flow of $63.2 million

Full Year 2024 Summary

Sales totaled $2.73 billion, a decrease of 3.0% vs. 2023

Net loss of $78.7 million, or $(4.48) per diluted share, reflected an improvement of $123.2 million vs. 2023

Net cash provided by operating activities of $76.4 million and free cash flow of $25.9 million

The Highlights

Cooper Standard has cut costs significantly. Improving loses even as revenue declined.

They're projecting declining vehicle production for 2025. Completely opposite to forecasts and manufacturers. In other words, they're sandbagging their forecasts!

Even with a lower production forecast they expect EBITDA to grow 20% in 2025

Revenue per vehicle has jumped to $190 from $175

Details from Earnings Call, Slideshow, and Report

Cooper Standard is basing these estimated made on the lowest forecast they could find. In other words SANDBAGING!

Final Thoughts

Cooper Standard has cut costs so aggressively that even a small uptick in vehicle production could lead to significant cash flow. Especially when management confirmed these cost cuts are sustainable. And they will not need to ramp up cost with production.

They've set conservative production forecasts for 2025, despite multiple signs pointing to growth:

Recent industry forecasts of increasing vehicle production

Increasing dealer incentives

Rising average age of vehicles

Strong actual sales numbers

Their risk reduction efforts have been so effective that I actually increased my position after the earnings dip. While it wasn't a huge addition, it shows my growing confidence in their strategy.

This remains my second-largest position - a clear sign of how excited I am about their future.

What do you think of the company?

Disclaimer:

This content is provided for informational and entertainment purposes only and should not be construed as professional financial or investment advice. The opinions expressed herein are solely those of the author, based on personal research and analysis, and do not reflect the views or advice of any financial institutions or licensed professionals. I do not have access to your personal financial situation, goals, risk tolerance, or investment preferences, and therefore cannot provide personalized investment recommendations. It is essential that you conduct your own research, carefully consider all relevant factors, and consult with a licensed financial advisor or other professional before making any investment decisions. Investing inherently involves risk, including the potential loss of principal, and past performance is not indicative of future results. I am not responsible for any decisions, actions, or outcomes resulting from the use of this content. Always ensure that your investments align with your personal financial situation and long-term objectives.

See you in the next edition!