They Wouldn’t Die, And Now Can’t Be Stopped

Everyone left this auto component company for dead. Now it’s back with leverage, momentum, and years of upside the market hasn’t caught on to. Don't miss it.

Welcome to 📉 DeepValue Capital 📈

The Turnaround Investing Newsletter

Every Wednesday, I cover one stock I own. Breaking down the original thesis, and providing updates as things evolve so you can maintain conviction to hold through noise. Because you can’t get the full benefit if you sell too early. I help you get real conviction.

This week’s spotlight? A company the market wrote off and left for dead. Now coming back stronger than ever, with the kind of upside that will reshape a portfolio.

Before we dive in, here’s why you should listen to me.

📈 From Jan 2024 to May 2025, my portfolio is up 178.98%. That’s 85.23% in 2024 and another 50.61% so far in 2025.

I won’t promise perfection. But I’ll put my money where my mouth is, stay transparent, and keep sharpening the edge.

Want the next deep dive, company update, and early setup before the market catches on?

Start your 14-day free trial and get full access to my portfolio, trade alerts, and turnaround research.

If you’ve got $20K (Or more) invested, a 5% edge generates at least $1,000 that compounds.

DeepValue Capital costs only $289/year.

👇 Try it free. Cancel anytime.

🔦 This Week’s Portfolio Spotlight: Cooper Standard (CPS)

My thesis: After massive cost cutting Cooper Standard is poised to capture huge margin increases as the vehicle manufacturing cycle turns driven by pent up demand, falling interest rates, rising incentives, and potentially regulatory action.

Valuation upside: When we see the auto cycle head back to a cycle peak at a 12x multiple this company is worth $150+ per share and over a $2.7B market cap. And that is before assuming ANY reasonably good news.

Here’s what’s coming:

✅ What Cooper Standard actually does

✅ The full thesis

✅ My valuation

And after a full breakdown of my portfolio, my holdings, costs basis, weights, and targets.

🧠 What Cooper Standard Does

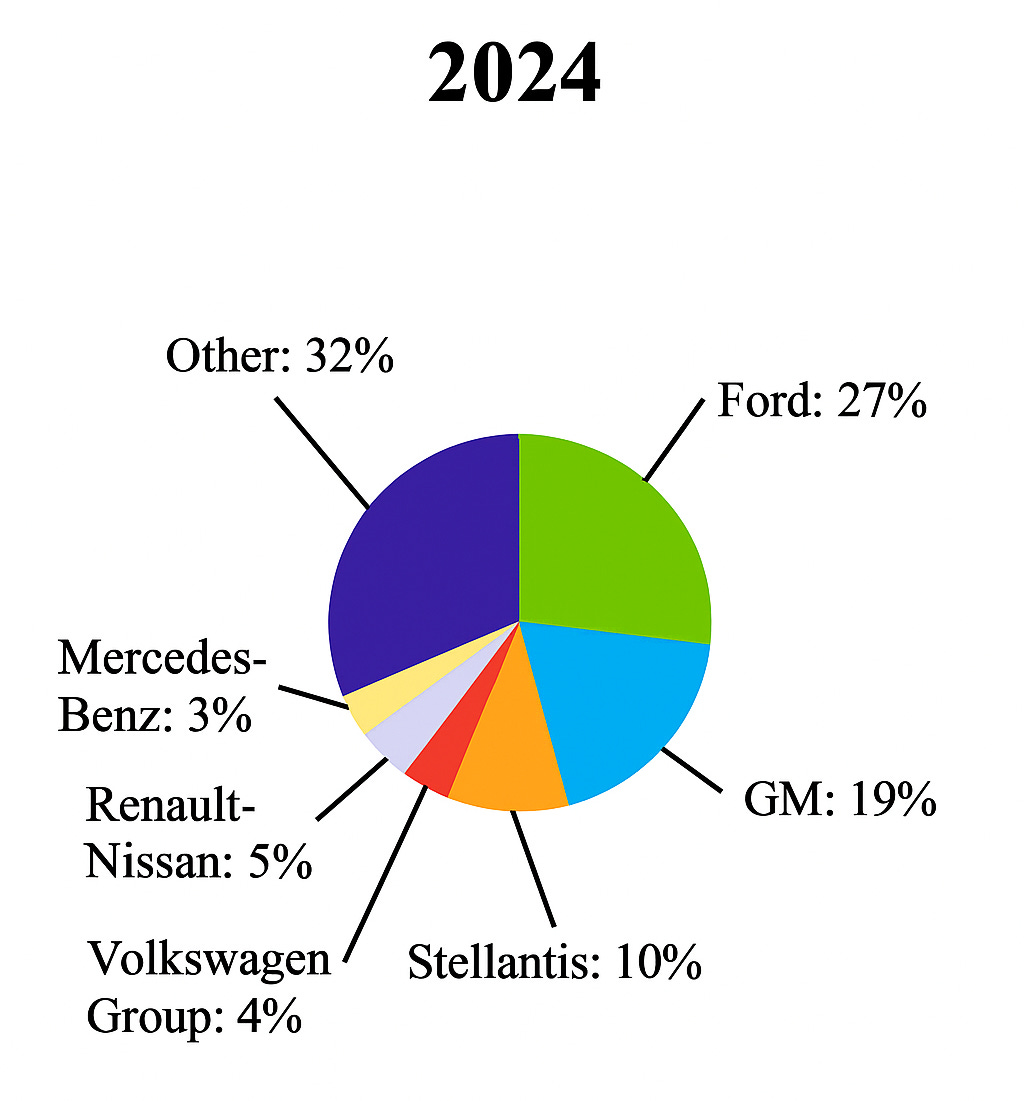

Cooper Standard is a Tier 1 automotive supplier. That means they sell finished, fully engineered, ready-to-install systems directly to automakers. Their 3 largest customers are Ford, GM and Stellantis combined making up 56% of their revenue.

Key offerings:

Sealing systems for doors, trunks, windows, and sunroofs.

Fluid handling systems for fuel, brake, coolant, and emissions.

Fuel & brake delivery tubing built for pressure and heat.

The business is split into two main buckets. Sealing systems and fluid handling systems.

On the sealing side, Cooper is the largest producer in the world. On the fluid side, they’ve carved out a niche in high-performance, lightweight, and EV-ready designs while still being one of the largest producers in the world.

Its not surprising they are such a big player when you look at their scale. Roughly 22,000 employees across 124 facilities in 20 countries, with headquarters in Michigan and a heavy footprint in North America and Europe. Asia-Pacific is a strategic focus area, especially as EV platforms ramp globally.

They’re also more involved with tech than most realize. Cooper has invested in AI-assisted compound development and virtual prototyping to speed up product cycles and reduce failure risk. Some parts can now be tested entirely in simulation before a single prototype is built.

The company’s innovation pipeline is impressive. Thermoplastic seals that reduce weight and emissions, integrated valve-pump units for EVs, and compact hubs that simplify complex cooling systems.

These aren’t sexy parts, but they’re vital and Cooper has a growing list of awards to prove it.

💡The Thesis

When I first looked at Cooper Standard the auto cycle was at a deep cyclical trough and things looked bleak. But digging below the surface, I realized the market was missing a massive opportunity.

Keep reading with a 7-day free trial

Subscribe to DeepValue Capital to keep reading this post and get 7 days of free access to the full post archives.