Portfolio Spotlight ($AAP) | The O'Kelly Effect

Inside the turnaround plan, the margin math, and why the market’s wrong about Advanced Auto Parts

👋 Hello all!

Welcome to 📉 DeepValue Capital 📈

THE Turnaround Investing Newsletter

Every Wednesday, I break down a stock I own. You get the full thesis, what’s changed, and the conviction to hold through the noise. You can’t get the full benefit if you sell too early, so don’t.

This week’s spotlight? A forgotten auto parts retailer that the market refuses to believe is actually turning around. And quicker than even the CEO expected

Before we dive in, here’s why you should listen to me:

📈 From Jan 2024 to May 2025, my portfolio is up 178.98%. That’s 85.23% in 2024 and another 50.61% so far in 2025.

Still not sure? On 8/10/24, I covered a little-known name: IHS. It’s up 107% since.

I am not promising perfection or that I won’t make mistakes. But that I will put my money where my mouth is, work to get you the best information, and keep getting better.

Want the next deep dive, company update, and early setup before the market catches on?

Start your 14-day free trial and get full access to my portfolio, trade alerts, and turnaround research.

If you’ve got $20K (Or more) invested, a 5% edge is worth at least $1,000.

DeepValue Capital costs $209/year and that upside compounds.

👇 Try it free. Cancel anytime.

This Week’s Portfolio Spotlight: Advanced Auto Parts (AAP)

No one expected this turnaround but the new CEO has taken risk off the table, will expand margins, and get growth back on the table.

My thesis: Shane O’Kelly will keep executing the turnaround, expand margins, and turn the business back to growth over time.

Valuation upside: 176% upside or 48.4% CAGR through 2027.

Here’s what’s coming:

✅ What AAP actually does and who they serve

✅ My full thesis on where this goes next

✅ The upside math

🧠 What AAP Actually Does

Advance Auto Parts is one of the largest aftermarket parts retailers in North America. Operating 4,285 company-owned stores and supplying 881 independently owned Carquest locations.

Most of their footprint is concentrated in the Eastern U.S., but they also serve Canada, Puerto Rico, the U.S. Virgin Islands, and parts of the Caribbean and Mexico.

They sell under two main banners Advance Auto Parts and Carquest.

Roughly 50% of sales come from professional installers, and 50% from DIYers. That mix has shifted over time as the company leans more into higher-margin professional demand.

What they Sell

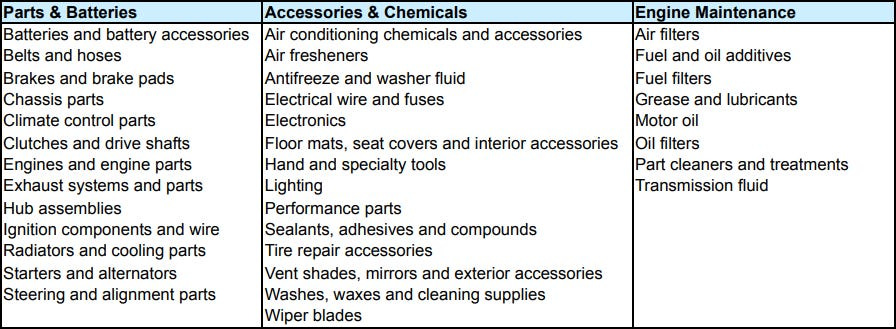

In-store, they offer a wide range of parts, tools, fluids, and accessories across key categories.

The Original Thesis

Advanced Auto Parts future wasn’t looking good but that all changed when Shane O’Kelly took over as CEO in September 2023.

Keep reading with a 7-day free trial

Subscribe to DeepValue Capital to keep reading this post and get 7 days of free access to the full post archives.