Portfolio Spotlight ($BABA) | The Best Deep Value AI Play in the World

A misunderstood Chinese giant powering AI, cloud, and e-commerce compounding again while the market looks the other way.

👋 Hello All

Welcome to 📉 DeepValue Capital 📈

You might be missing the most complete AI play in the world.

It’s China’s #1 retailer, cloud provider, and AI infrastructure backbone all in one.

And yet no one’s paying attention.

Along with covering this company at the end paid subscribers get the full picture of my holdings and weights.

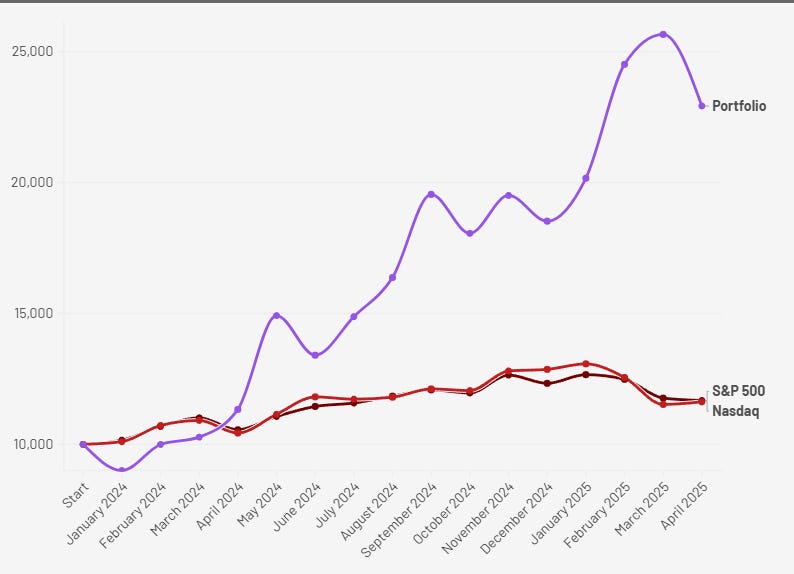

But before we dive in, here’s how my portfolio has performed so you know this strategy works:

📈 From January 2024 to April 30th 2025 my personal portfolio is up 129.23%. YTD after an incredible May I am up 61%.

All from mispriced, misunderstood, optionality-rich setups like this.

If you want the next 3x setup before the market wakes up to it, subscribe below and get a 14 day free trial.

📦 This Week’s Spotlight: Alibaba ($BABA)

The market still sees Alibaba as a stale e-commerce bet in a shaky macro.

But the business is quietly shifting in ways that most investors aren’t seeing:

Operating cash flow up 18% YoY showing early signs of leverage returning.

88VIP loyalty members crossed 50 million, with double-digit growth.

Cloud revenue accelerating +18% YoY, EBITA up 69%.

AI products compounding at 100%+ YoY for 7 straight quarters.

Capital being deployed with $11.9B in buybacks, $4.6B in dividends.

The headlines haven’t changed. But the fundamentals have, and that disconnect is exactly where the opportunity lies.

🧠 What Alibaba Does

Alibaba isn’t a single company.

It’s a misunderstood conglomerate with high-leverage bets on e-commerce, AI, logistics, and international scale each with paths to serious cash flow.

🛒 1. Taobao + Tmall

Alibaba’s core marketplace business in China — and still its biggest cash engine.

Taobao is consumer-to-consumer: small sellers, influencer shops, and livestream product drops.

Tmall is business-to-consumer: Nike, Apple, and 200,000+ verified storefronts.

Unlike Amazon, Alibaba doesn’t hold inventory. And most of its monetization doesn’t come from taking a cut of sales. Taobao earns primarily through ads — merchants bid for traffic, visibility, and promotion tools. Tmall adds a small commission layer on top, but ads and data tools still drive most of the revenue.

What’s next: Management is leaning into premiumization — improving product quality, loyalty perks, and customer experience. That sets the stage for better retention and higher-margin monetization.

🌍 2. Alibaba International (AIDC)

This is Alibaba’s global e-commerce arm a collection of regional platforms tailored to local markets:

AliExpress targets global bargain hunters

Lazada serves Southeast Asia

Trendyol leads in Turkey

Daraz operates in Pakistan and Bangladesh

All four plug into Alibaba’s cross-border logistics and payments infrastructure.

What’s next: Management expects profitability in fiscal 2026, with unit economics already improving at AliExpress and other markets. AIDC is shifting from scale-at-any-cost to disciplined contribution.

☁️ 3. Alibaba Cloud

The leading cloud provider in China — selling compute, storage, AI services, and enterprise software. It powers both Alibaba’s ecosystem and third-party clients across retail, finance, and media.

What’s next: Revenue grew +18% YoY, but EBITA grew +69%. Cloud is no longer a drag, it's showing operating leverage as AI workloads scale and external adoption accelerates. Management expects momentum to continue into next quarter.

🚚 4. Cainiao (Logistics)

Alibaba’s fulfillment and logistics network — built to deliver packages anywhere in China within 24 hours, and increasingly used in global shipping lanes.

What’s next: Revenue declined this quarter as more logistics capacity was absorbed internally. But losses narrowed significantly YoY, and Cainiao remains a critical edge as cross-border commerce expands.

🍜 5. Local Services

Ele.me is China’s food delivery network

Amap is a navigation and maps layer used by hundreds of millions

What’s next: Orders are growing, losses are shrinking, and unit economics are improving with scale. Management continues to entrench Alibaba deeper into everyday mobile-first transactions.

🎬 6. Digital Media + Others

This segment includes content and new-format bets like:

Youku (streaming video)

Alibaba Pictures (film production)

DingTalk (enterprise messaging and collaboration)

Freshippo (tech-enabled grocery)

Alibaba Health, plus other smaller plays

What’s next: Still early-stage and mostly unprofitable — but Youku hit adjusted EBITA breakeven this quarter, and management is positioning DingTalk and Freshippo for longer-term monetization.

💰 Q4 Earnings and Alibaba’s Bright Future

Alibaba reported on 5/15/2025, and beneath the noise, the fundamentals are moving in the right direction. Growth is returning, margins are expanding, and capital is being put to work.

Here’s what stood out this quarter:

Keep reading with a 7-day free trial

Subscribe to DeepValue Capital to keep reading this post and get 7 days of free access to the full post archives.