Tactile Systems | Deep-Dive, The Case For $50+

Coverage with 275M lives, new Nimbl ramp, AffloVest share gains, and SG&A leverage. Read here for the full thesis, valuation, and risks.

Welcome to 📉DeepValue Capital📈

The Turnaround Investment Newsletter

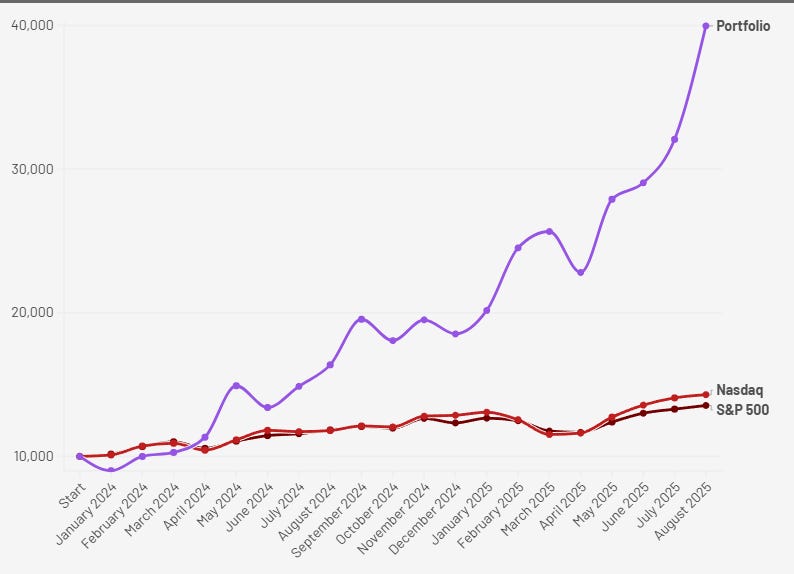

From the start of 2024 to month end August 2025, my portfolio is up 299.66%.

This year alone, I’m sitting on +115.77% YTD through August.

All earned from setups like this. Mispriced, unloved, and no one paying attention.

I want to be clear, these are not the returns I expect, I hope for them but cannot expect them. My goal is to AVERAGE 30% per year. That means I can almost guarantee lower returns going forward and will also almost certainly have years of negative returns.

With that said back to the article.

This week’s Deep-Dive covers Tactile Systems ($TCMD).

The setup?

A niche medical device company with growth ahead, expanding margins, impeccable balance sheet, and category leading products.

If you don’t know the name, I’ll walk through it all:

What they do.

Why they are interesting today.

Their management.

The risks.

And why I expect $50+ per share (More than 4x from today’s price of $13)

Let’s get into it.

What Does Tactile Systems Do?

At its core, Tactile Systems Technology, also know as Tactile Medical, builds and delivers at-home medical devices for chronic and undertreated conditions.

They were founded in 1995 and began operating under their current name in 2013. Today they generate $293 million in annual revenue (2024) and organizes their business into two main segments. Vascular and lymphedema care, and respiratory care.

Vascular and Lymphedema Care (89% of revenue)

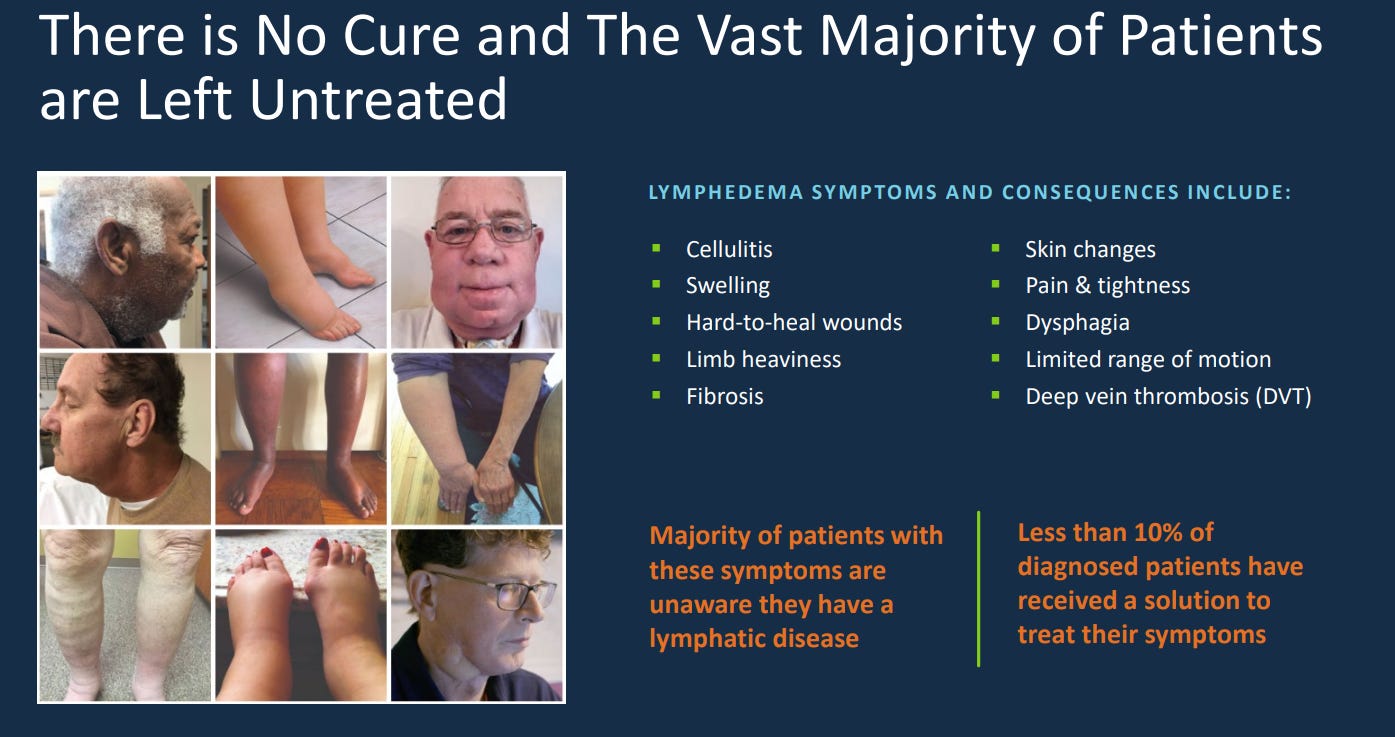

Lymphedema is chronic swelling that occurs when the lymphatic system can’t drain fluid effectively. It leads to pain, reduced mobility, recurring infections, and long-term tissue damage. There’s no cure, but it can be managed. Common causes are cancer, obesity, infections, and trauma.

Chronic venous insufficiency (CVI) happens when vein valves in the legs don’t function properly, creating venous hypertension. This can cause painful ulcers and, over time, overwhelm the lymphatic system. Resulting in a combined venous and lymphatic disease. Common causes are obesity, age, sedentary lifestyle, and smoking.

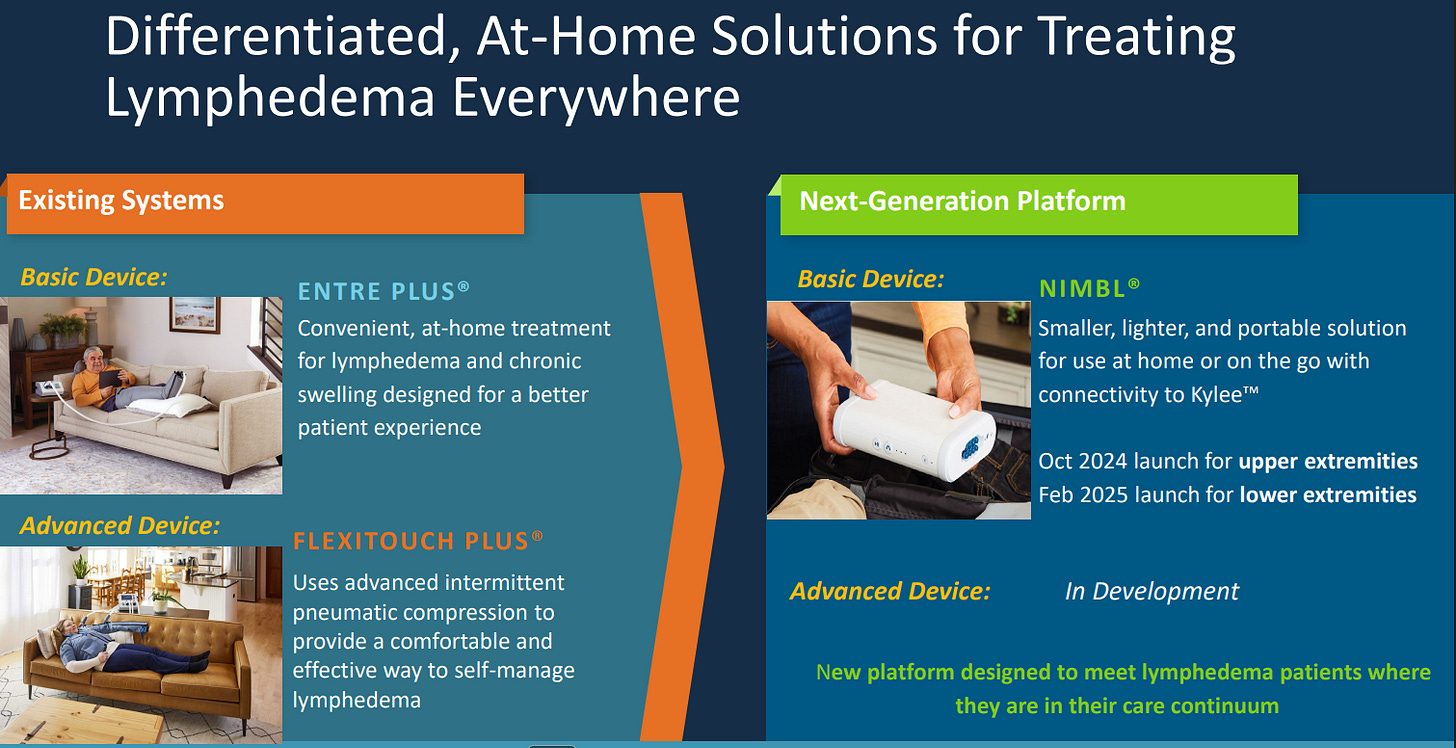

These conditions are progressive, costly, and significantly impact quality of life. Tactile’s devices automate therapy that was once clinic-based. Giving patients a way to manage their disease from home. Their main offerings to treat these conditions include:

Flexitouch Plus: The flagship advanced pneumatic compression device (APCD), cleared for multiple forms of lymphedema, phlebolymphedema, lipedema, and venous insufficiency. It’s the only device with FDA clearance to treat head and neck lymphedema, a common consequence for cancer survivors.

Entre Plus: A simpler, portable pump designed for patients who either don’t yet qualify for an advanced device or need something easier to use.

Nimbl: Their newest platform, launched in late 2024, which modernizes sequential compression with streamlined garments and Bluetooth connectivity.

Kylee App: A digital companion that tracks treatment sessions, symptoms, and progress, while connecting patients with clinicians.

By combining direct to patient sales with a “white-glove” approach, (handling insurance authorizations, shipping devices, and providing training ) Tactile embeds itself into the full continuum of patient care. This allows them to capture both manufacturer and distributor margin while keeping patients adherent and clinicians engaged.

Respiratory Care (11% of revenue)

Tactile also addresses chronic respiratory conditions where mucus buildup leads to infections and progressive lung damage.

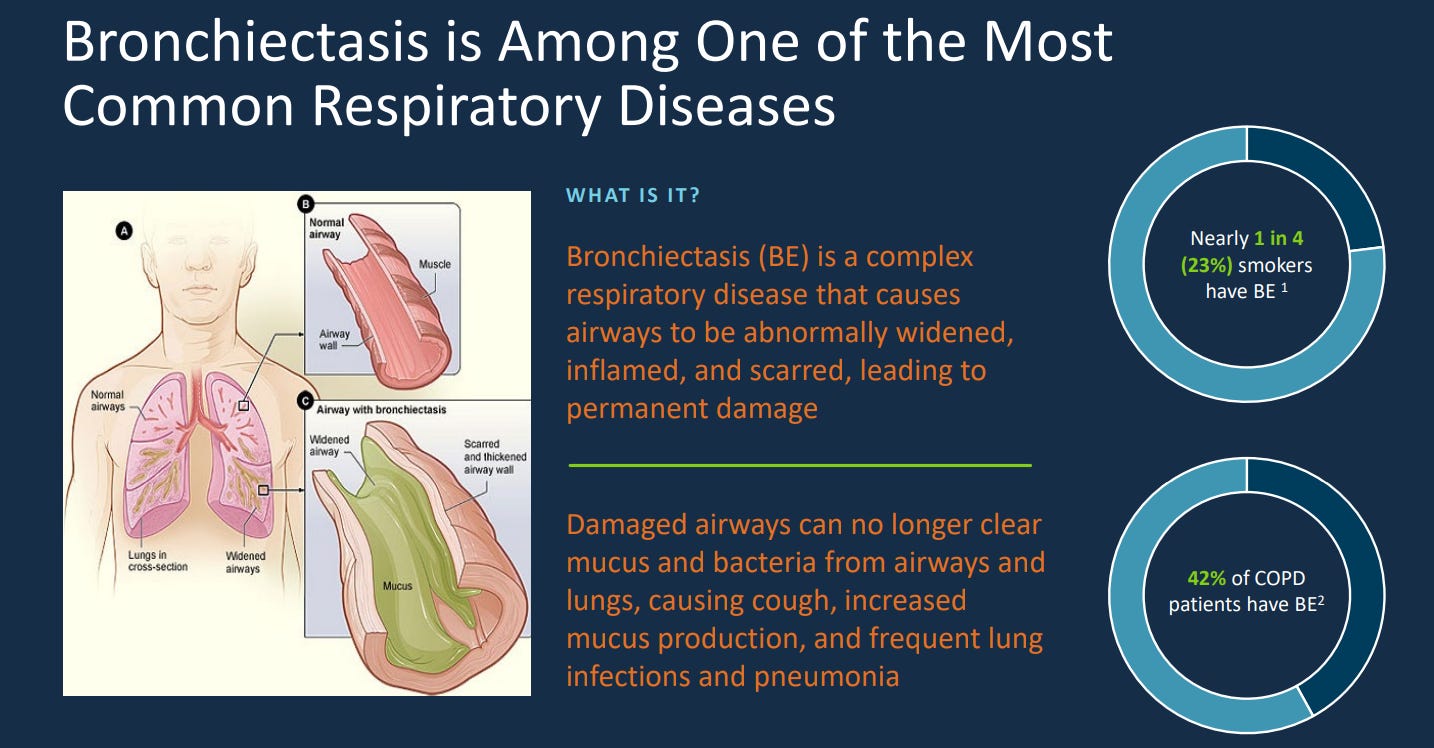

Bronchiectasis is permanent widening and scarring of the airways that trap mucus, creating a cycle of infection and inflammation. Common causes are cystic fibrosis, repeated infections, and autoimmune disease.

Other conditions including neuromuscular disorders, where impaired airway clearance increases risk of chronic respiratory decline.

These diseases are lifelong, costly to manage, and require daily therapy to maintain lung health. For many patients, adherence is difficult with older, clinic-bound technologies.

Their main offering is:

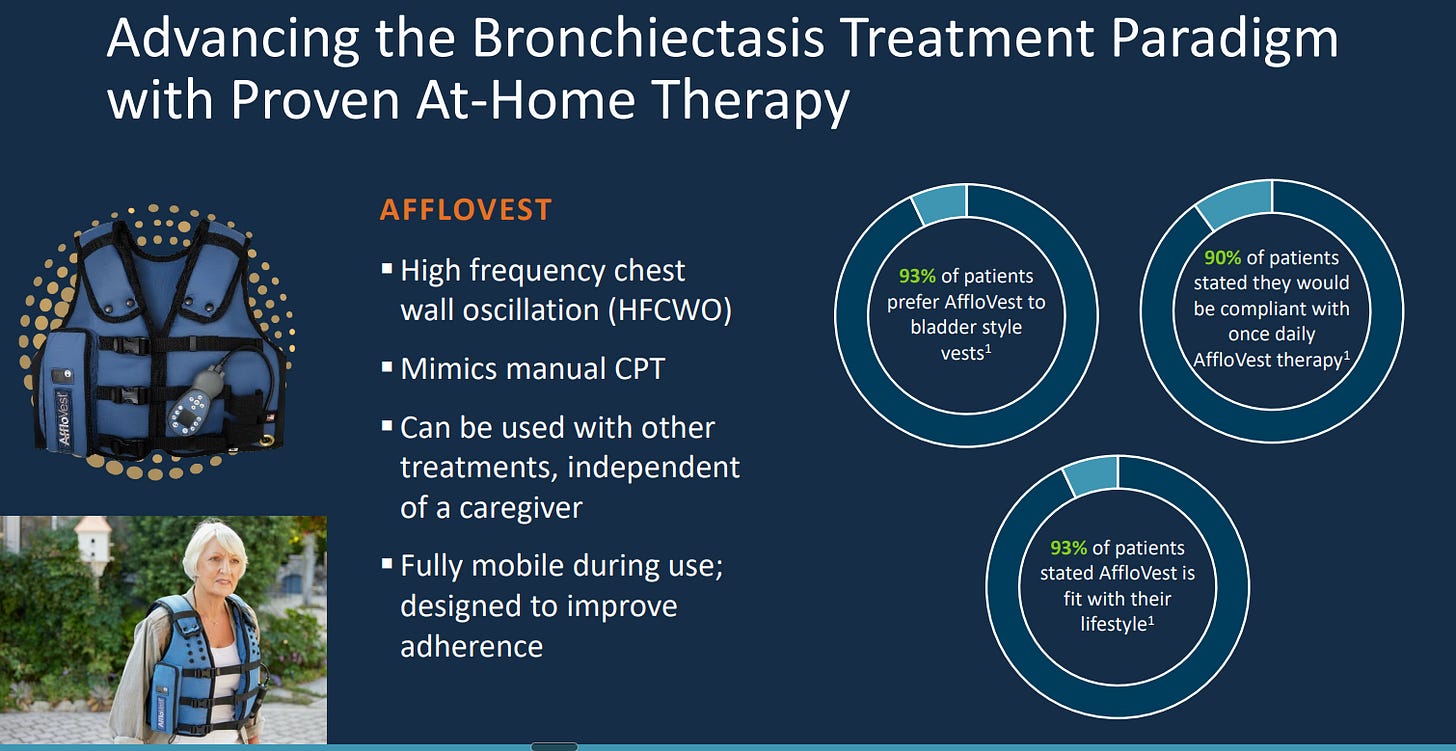

AffloVest: a portable, battery-powered high-frequency chest wall oscillation (HFCWO) vest with eight motors that loosen and mobilize mucus from the lungs. Unlike traditional compressor-based vests, AffloVest is fully wearable, allowing patients to move freely during treatment and improving the likelihood of consistent use.

The product is distributed through durable medical equipment (DME) providers who manage reimbursement, training, and patient support, giving Tactile a scalable way to reach the respiratory community.

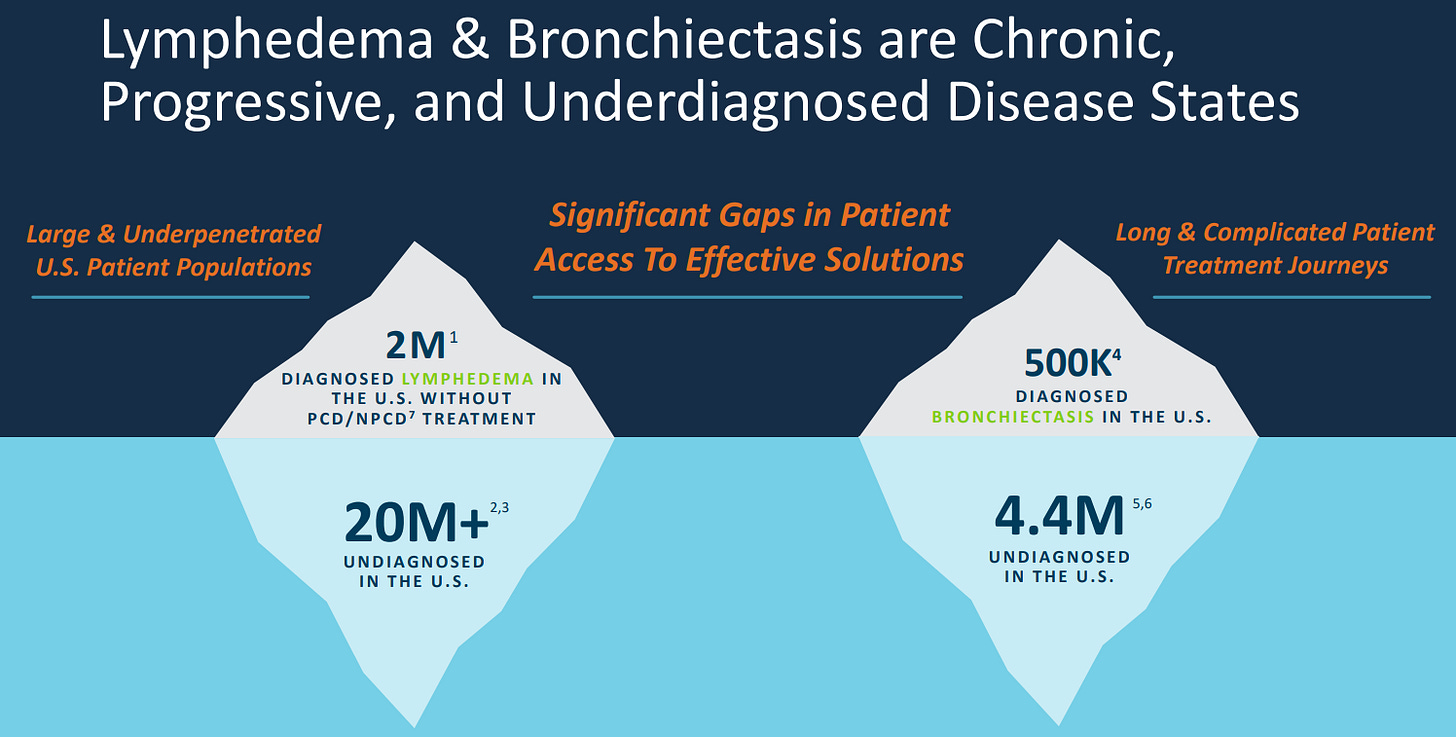

Turning to the industry as a whole, all of these conditions remain largely undiagnosed in the US. Representing future growth opportunity.

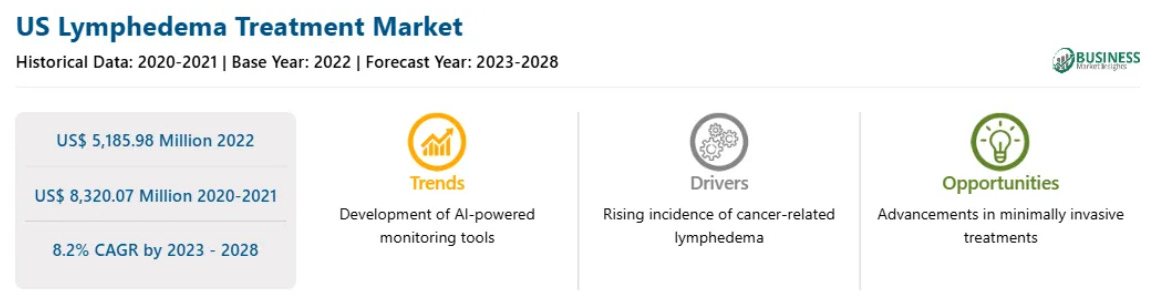

The Lypodema treatment market is expected to grow at over 8% per year according to Business Market Insights. With 4 other forecasts ranging from 6% to 9.5% CAGR backing this up.

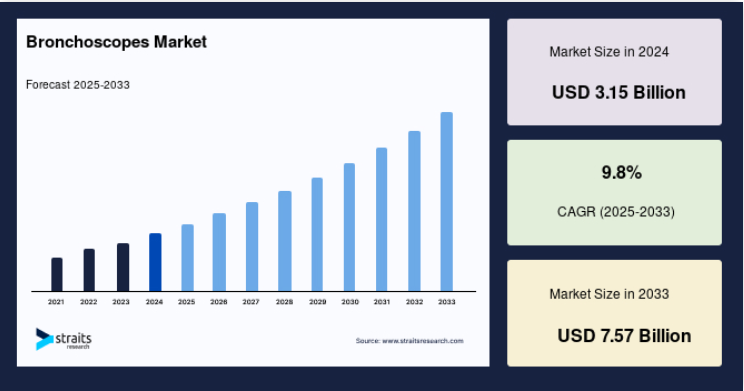

The Bronchiectasis market, according to Stratis Research, will grow and 9.8% per year with other forecasts varying more widely from 4.7% up to 14.5% though it does seem more concentrated on the higher end of this range.

If you take a step back to look at the root causes of these diseases with driving factors like cancer, obesity, age, sedentary lifestyle, cystic fibrosis, repeated infections, and autoimmune disease. You find they are only becoming more prevalent, survivors of the conditions are living longer, or both. With those drivers a natural industry tailwind in the high single digits is reasonable.

To service and access these growing markets Tactile has built infrastructure around reimbursement, payer coverage, and clinical validation. They are in-network with payers covering about 275 million lives across private insurers, Medicare, the VA, and Medicaid.

In 2024 60% of Tactile’s business went through private insurance, 18% through Medicare, 11% from the VA, and 11% through a DME.

They’ve built expertise in navigating prior authorizations and appeals, and historically maintain high approval rates. Critical in markets where coverage drives adoption.

Equally important is their evidence base. Over 25 clinical studies have demonstrated that Tactile’s devices reduce swelling, lower infection rates, cut hospitalizations, and meaningfully improve quality of life. That clinical proof not only helps patients and clinicians trust the devices, but also convinces payers to reimburse at scale.

Tactiles market leading position in both segments AND their large insurance coverage base mean great competitive advantages and a bright future.