Still Breathing, But the Bleeding Hasn’t Stopped

A cautionary breakdown of a 97% loser, still alive but only barely.

👋 Hello All

Welcome to 📉 DeepValue Capital 📈

Every Friday, I break down early-stage ideas most investors are ignoring.

This is not a buy call. Especially this week.

It’s a red flag worth understanding because knowing what to avoid is just as important as knowing what to chase. I do the digging so you don’t have to.

This week’s First Look features a stock I have completely written off… despite no near-term debt maturities, a global manufacturing footprint, and a customer list that includes some of the biggest names in autos.

But before we dive in, here’s why this matters:

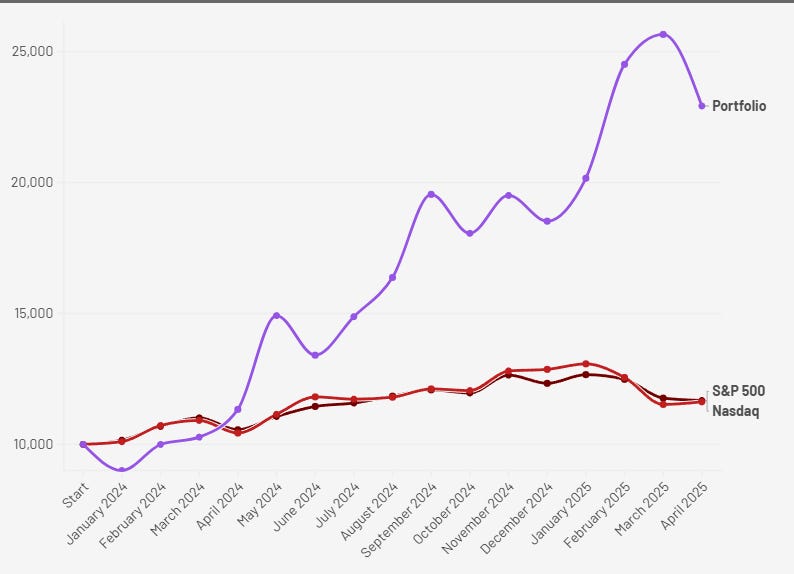

📈 From Jan 1, 2024 to April 30 2025, my personal portfolio is up 129.23%. Then YTD after an incredible May, +66%.

To get those returns, I need to know the difference between a turnaround… and a terminal decline.

Want the next setup before the crowd? Subscribe below and I’ll send it your way.

This week’s focus: Superior Industries (SUP)

The stock is down 97%.

They just lost a third of their customers.

And the debt is piling up.

I’m not buying it. But there’s a reason I looked.

We’ll walk through:

✅ What they actually do

✅ Why this isn’t a pitch, it’s a lesson

✅ What would have to change for this to become interesting

What They Do

Superior Industries makes aluminum wheels for cars both for global automakers and European consumers.

Their core business is OEM supply. Wheels custom-built for vehicles made by GM, Ford, Toyota, Volkswagen, and others. These are engineered to match specific models and installed right at the factory.

Production happens in Mexico (serving North America) and Poland (serving Europe).

The second leg is their aftermarket business. It is smaller, but often more profitable. Through brands like ATS, RIAL, and ALUTEC, they sell replacement and upgrade wheels directly to European drivers through tire shops, parts dealers, and online.

That’s the business. Now here’s why the stock is circling the drain.

Why I Looked at This (But Still Walked Away)

The crash got my attention.

After pulling guidance and announcing huge customer losses, the stock fell 65% in a day.

Then I saw this:

No major debt due until 2027–2028

Reasonable near term liquidity

Historically FCF positive (now trades at less than 0.2x 2022 free cash flow)

Long term growing revenue

Vehicle sales are rebounding back to cycle highs

So on the surface, it looks like the kind of setup I love. It is distressed, hated, and cheap.

But underneath?

There’s nothing to work with.

A Business in Decline and a CEO Who Can’t Fixed It

Let’s just call it what it is.

Superior has been bleeding for years and the turnaround has not come.

Since 2019, when Majdi Abulaban took over as CEO, the company has:

Lost major customers

Burned through cash

Diluted shareholders

And dropped ~90% in stock price

That’s not a rough patch. That’s a failed plan.

And it’s not like this guy was untested. Abulaban came from Aptiv (formerly Delphi), where he spent over 30 years and eventually led their biggest segment, Signal and Power Solutions. Under his leadership there, growth was strong, margins were solid, and Aptiv’s stock compounded like crazy.

But this is a different game. Aptiv was a $14B juggernaut with tailwinds. Superior is a debt-heavy small-cap supplier fighting to stay alive.

And that contrast shows.

Since Abulaban stepped in:

Revenues are down 8%

Gross margins are stuck around 8–9%

SGA costs have increased more than 70%

Net income has been mostly negative

~$295M in goodwill impairments have been taken in Europe

To his credit, Abulaban did buy time: pushing out debt maturities to 2027–2028 and raised $520M in new capital. But none of it has led to growth, or profitability, or any reason to think shareholders will be made whole.

Investor sentiment has shifted from hopeful to skeptical. Analysts who once praised his “operational excellence” now mostly highlight tactical cost cuts and the lack of real earnings power. The board still supports him but it’s hard to call his tenure anything but value-destructive.

He was supposed to bring the Aptiv playbook. Instead, he’s presided over one of the worst stretches in the company’s 60-year history.

And that’s why, for me, this isn’t a leadership team I’m willing to bet on.

What Would Have to Change for Me to Care?

One thing: a world-class CEO with a track record in auto supplier turnarounds.

Not just “industry experience.” Not a board reshuffle. Not a vague plan.

I mean someone who’s rebuilt credibility with OEMs, landed real contracts, and knows how to pull a broken supplier out of a death spiral.

Short of that?

They’re just another small-cap wheel maker with no moat, no leverage (the good kind), and no clear way out.

Final Thoughts

Here’s what I want you to take away.

👉Just because a stock is cheap doesn’t mean it’s investable.

In fact, most of the time when a name trades at ridiculously low valuations, it’s for a good reason. The upside is a mirage.

Deep value only works when there’s something left to fix.

Superior might technically survive. But without a major shift in leadership, customer wins, or capital structure shareholders won’t win.

I’ll keep an eye on it because anything this wrecked deserves a pulse check once in a while. But right now?

🚫 This is exactly the kind of company I avoid.

📬 4 More Articles You’ll Love

New here? Start with these:

Read This Before You Subscribe.... After Works Fine Too - Who I am and what DeepValue Capital Offers.

My Step-by-Step Guide to Outperformance - My investing system broken down in step by step detail for you.

Disclaimer:

This content is provided for informational and entertainment purposes only and should not be construed as professional financial or investment advice. The opinions expressed herein are solely those of the author, based on personal research and analysis, and do not reflect the views or advice of any financial institutions or licensed professionals. I do not have access to your personal financial situation, goals, risk tolerance, or investment preferences, and therefore cannot provide personalized investment recommendations. It is essential that you conduct your own research, carefully consider all relevant factors, and consult with a licensed financial advisor or other professional before making any investment decisions. Investing inherently involves risk, including the potential loss of principal, and past performance is not indicative of future results. I am not responsible for any decisions, actions, or outcomes resulting from the use of this content. Always ensure that your investments align with your personal financial situation and long-term objectives.

It is very illuminating to see the other side of the coin - i.e the many stocks that don't make the grade and get filtered out by your obviously very detailed process. There must be so much junk out there and only a few gems hiding under the stones - but your process is obviously very effective at digging them up and distinguishing between junk and gem. So happy to be a subscriber and to have benefitted from gems like CPS and IHS while avoiding junk like this. Great work Kyler, very happy to be a subscriber!