New Idea ($ICLR) | Quietly Printing $1B While Biotech Burns

First Look | ICON’s stock is down 60%, but it still has a massive backlog, healthy cash flow, and sector tailwinds. The market stopped caring but should it?

Hello all 👋

Welcome to 📉 DeepValue Capital 📈

Every Friday, I break down one early-stage setup that the market’s overlooking.

It’s not a buy call it’s a head start to the research. You get the idea. I do the work.

This week’s first look post looks at a stock the market’s written off… despite sitting on $25B in contracted trial work.

But before we get there let me show you why this process works.

📈 Since January 2024, my portfolio is up 156.56%.

YTD, I’m up about 18.5%. All from tracking setups like this. Mispriced. Misunderstood. Loaded with optionality.

If you want the next idea before it runs, or before the market even cares, subscribe below and I’ll keep sending them your way.

This week’s First Look: ICON plc (ICLR)

The market doesn’t trust it. I’m trying to figure out if that’s a mistake.

ICON is down over 60% since last July. They’ve got lawsuits, funding pressure, and client cutbacks.

But they’re also sitting on a $25 billion backlog, earning over $1 billion in free cash flow, and quietly benefiting from one of the biggest R&D tailwinds in biotech history.

This post will walk you through:

✅ What ICON actually does

✅ What’s quietly shifting in their favor

✅ Key risks and upside math

🧠 What ICON Actually Does

ICON is a CRO, short for Contract Research Organization.

When a drug company wants to bring a new medicine to market, it needs to test it through clinical trials. That process is long, expensive, and complex.

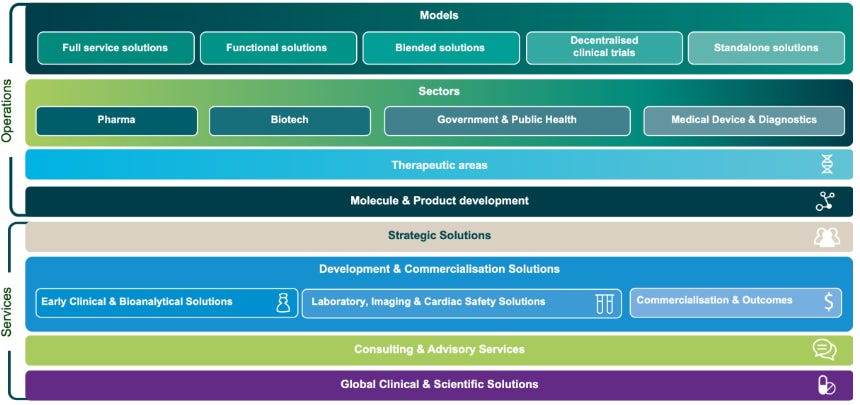

Rather than do it all in-house, most companies outsource it. ICON handles everything from finding patients to managing data to staying in compliance with regulators.

ICON is the operational engine behind drug development. They don’t own the drugs. They run the process.

And that’s why I’m looking at them. I don’t invest in biotech directly. I don’t pretend to understand drug pipelines or regulatory risk well enough.

But I do understand service businesses. Especially ones with scale, recurring work, and high return on capital.

ICON fits that mold.

🔥 Why It’s Interesting

The stock is down more than 60 percent since July 2024.

Backlog is $25 billion, still near all-time highs.

Historical ROIC and ROCE around 15 percent.

Pharma R&D budgets are set to grow structurally.

That last point is what makes this setup more than just a technical bounce.

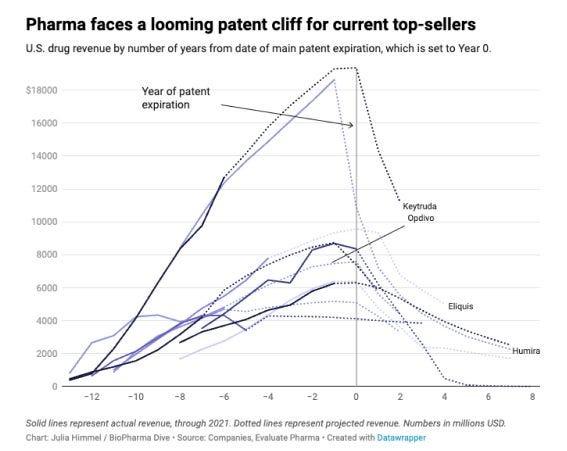

Global pharma companies are facing a major patent cliff this decade. Over $200 billion in annual drug revenue is at risk between now and 2030. That’s forcing companies to aggressively rebuild their pipelines which means more R&D, more molecules, and more trials.

At the same time:

Aging populations are driving long-term demand for chronic and complex treatments.

AI is speeding up drug discovery, but trials are still essential.

Biotech VCs are shifting to quality, funding later-stage trials and M&A-ready startups.

And geopolitical shifts are leading to more global trial diversification.

Put it all together, and trial activity isn’t just bouncing it’s becoming a structural need.

ICON doesn’t need any one drug to succeed. It just needs more attempts and all signs point to that happening across the board.

⚠ Key Unknowns and Risks

This isn’t a full thesis yet. It’s still early research.

Before I can get serious about ICON, a few things need to get clearer and a few risks need to be respected.

Here’s what I’m still working to understand:

How real is the $25 billion backlog? A lot hinges on whether trust in their accounting holds.

What do executive incentives actually look like? Are insiders aligned with long-term shareholders?

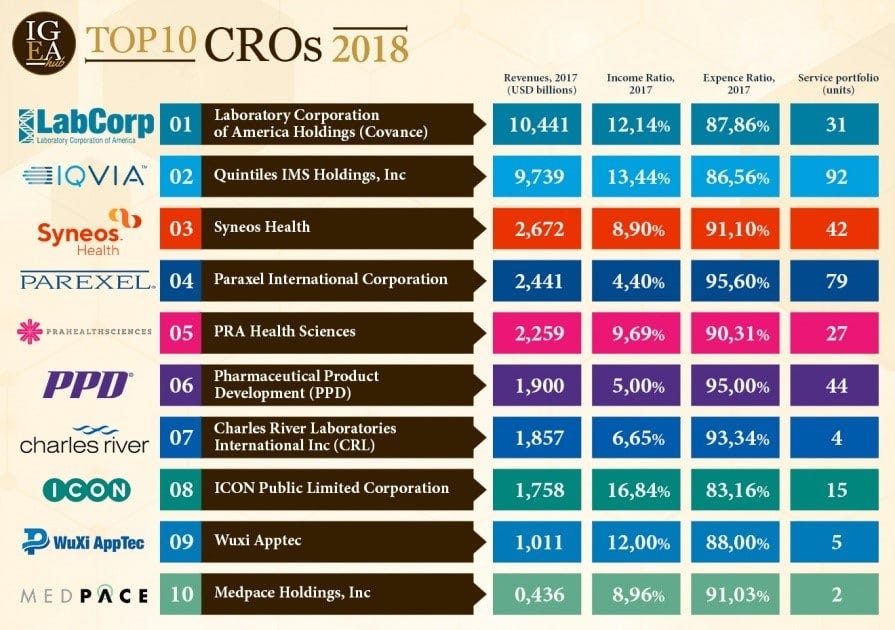

What makes ICON stand out versus their competitors? Do they have a real advantage against them?

And here are the risks that could break the story:

If the lawsuit reveals deeper credibility issues, it’s hard to rebuild trust.

If ICON falls behind competitively, clients may shift trials elsewhere.

If AI displaces core functions margins could compress.

None of these risks feel imminent. But over the next 5 years, they matter.

📉 Back of the Napkin Valuation

Let’s keep it simple.

ICON did just over $1.1B in free cash flow last year.

If they grow FCF at just 5% annually, reasonable given their backlog and long-term tailwinds. They could be generating $1.3B in FCF three years from now.

Apply an 18x multiple, and you’re looking at a $23B valuation.

Today, ICON trades around $11B.

That’s about 110% upside, or a 28% CAGR over three years.

And if they return to their historical 23% growth rate since 2010?

You’re suddenly looking at a 235% return, or nearly 50% CAGR.

If you can get clear on the questions above, ICON offers an interesting way to get exposure to biotech without betting on drug pipelines.

It won’t be added to my portfolio today, I don’t have the cash to build a meaningful position, but it’s a perfect example of the kind of setup I track.

It shows what happens when sentiment breaks and Wall Street stops caring.

I’ve got more of these coming.

Same process. Same playbook. Different setups.

Stick around if you want to see what else I’m digging into.

3 More Articles You Will Love

New here? Start with these:

Read This Before You Subscribe.... After Works Fine Too - Who I am and what DeepValue Capital Offers.

My Step-by-Step Guide to Outperformance - My investing system broken down in step by step detail for you.

Disclaimer:

This content is provided for informational and entertainment purposes only and should not be construed as professional financial or investment advice. The opinions expressed herein are solely those of the author, based on personal research and analysis, and do not reflect the views or advice of any financial institutions or licensed professionals. I do not have access to your personal financial situation, goals, risk tolerance, or investment preferences, and therefore cannot provide personalized investment recommendations. It is essential that you conduct your own research, carefully consider all relevant factors, and consult with a licensed financial advisor or other professional before making any investment decisions. Investing inherently involves risk, including the potential loss of principal, and past performance is not indicative of future results. I am not responsible for any decisions, actions, or outcomes resulting from the use of this content. Always ensure that your investments align with your personal financial situation and long-term objectives.

I work at a CRO, feel free to reach out if you would like.

One thing I’ve noticed recently is that biopharmas seem to be cutting costs wherever possible, and while they aren’t being transparent about why I think it is likely due to Trumps EO about drug pricing and them staring down the barrel of lost revenue, so they need to pull things in house.

Contract modifications can take a few months, so returning that backlog isn’t immediate. Also, indirect costs can take longer to return but still prop up the 606 revenue.

Looks like a potentially very good opportunity