Alibaba | Finally Putting The Pieces Together

Commerce cloud instant delivery and AI aligned into one platform again.

Welcome to 📉DeepValue Capital📈

The Turnaround Investment Newsletter

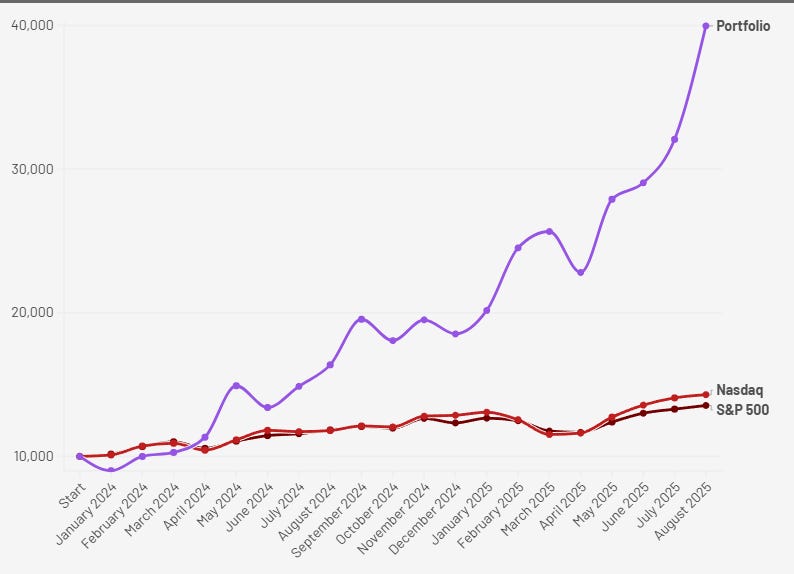

From the start of 2024 to month end August 2025, my portfolio is up 299.66%.

This year alone, I’m sitting on +115.77% YTD through August.

All earned from setups like this. Mispriced, unloved, and no one paying attention.

I want to be clear, these are not the returns I expect, I hope for them but cannot expect them. My goal is to AVERAGE 30% per year. That means I can almost guarantee lower returns going forward and will also almost certainly have years of negative returns.

With that said back to the article.

This week’s portfolio update covers Alibaba ($BABA).

If you’re new here, don’t worry. I’ll walk through everything.

By the end of this, you’ll know:

✅ What they do.

✅ What happened in their recent earnings.

✅ What tailwinds and changes are driving the thesis.

✅ The risks.

✅ Why I still see $350+ per share.

Let’s get into it.

What Alibaba Does

Alibaba is a high-leverage holding company sitting at the intersection of commerce, cloud, and AI.

Because it’s sprawling and in the past a little chaotic, it’s often misunderstood.

But now each segment is being deliberately refocused, around core e-commerce and an AI backbone.

Here’s how the business breaks down with the new reporting and consolidation:

1. China Retail (Tmall, Taobao, Instant Commerce, and Travel)

Alibaba’s core business is commerce. And the foundation of that has long been two platforms:

Taobao

Consumer-to-consumer. Think small merchants, livestream influencers, and storefronts run by individuals. It runs mostly on ads, in fact they are one of the largest ad sellers in China. Sellers bid for visibility and access to shoppers.

Tmall

Business-to-consumer. This is where major brands operate. Names like Apple, Nike, and L’Oréal. Monetization is layered with ads plus a small fee across 200,000+ verified storefronts.

Until recently, Ele.me (Alibaba’s food delivery arm) sat in a separate business unit.

That changed this summer. Ele.me was folded into the China Retail segment, bringing instant commerce into the same ecosystem as Taobao and Tmall.

Instant commerce: fast delivery of physical goods in under 60 minutes.

Before, this kind of delivery was limited to meals and groceries ordered directly through Ele.me.

Now, the integration allows customers to get near-instant delivery of products from Taobao and Tmall, enabled by Ele.me’s fulfillment network of about 2 million drivers.

More on what this means for Alibaba later.

Then just in this most recent quarter Alibaba also pulled in Fliggy, which offers comprehensive travel services, into this segment to further enhance the offering of the Taobao app.

2. Alibaba International (AIDC)

This is Alibaba’s global e-commerce division, a collection of regionally tailored platforms:

AliExpress: Cross-border discount retail

Lazada: Southeast Asia

Trendyol: Turkey

Daraz: Pakistan and Bangladesh

Each runs on Alibaba’s shared infrastructure, payments, logistics, and merchant tools. They're edging closer to breakeven, with full profitability still targeted by fiscal 2026.

3. Alibaba Cloud

Alibaba Cloud is the largest cloud infrastructure provider in China and one of the most strategically important assets in the Alibaba portfolio.

It provides the compute backbone that powers everything from Taobao traffic surges to enterprise AI workloads.

The business offers a full stack of services including elastic compute, storage, databases, content delivery, enterprise software, and developer-facing AI tools.

It also develops and hosts its own family of large language models, branded Qwen, which now power product recommendations, smart search, and customer service across the Alibaba ecosystem.

It supports both Alibaba’s internal apps and external clients across sectors like finance, retail, logistics, and public services.

In China, Alibaba is the category leader, with an estimated 33% share of the domestic cloud market. It’s ahead of Tencent and Huawei, and it’s the only Chinese provider with real global reach.

The company continues to expand across Southeast Asia and the Middle East, aiming to become the default cloud provider for emerging-market AI applications.

4. Cainiao, Digital Media, Freshippo, and Other Bets

This segment includes a wide variety of businesses with Cainiao being the largest and most important.

They are Alibaba’s logistics arm, built to guarantee 24-hour delivery across China and enable efficient, scalable global shipping.

From its founding in 2013, it’s grown into a smart logistics network that spans over 200 countries, with more than 1,100 warehouses and millions of square meters of cross-border capacity.

It combines owned infrastructure with third-party carriers, layered with AI and data tools that optimize routing, track packages in real time, and reduce last-mile friction. Cainiao Stations handle local pickup and drop-off.

Dedicated lanes now offer five-day and ten-day international delivery, with 72-hour cross-border fulfillment becoming the new target in key markets.

It powers Alibaba’s ecosystem, and sells that scale to others. Even competitors. Turning logistics into a leveraged platform rather than a cost center.

Other smaller businesses lumped into this segment are:

Youku (streaming)

Amap (mapping + traffic)

Alibaba Pictures (film production)

DingTalk (enterprise messaging)

Freshippo (tech-enabled grocery)

Alibaba Health, plus other verticals

Most of these are still unprofitable. But are improving meaningfully.

Alibaba has also used its capital and infrastructure to take stakes in emerging platforms. Particularly across AI, fintech, and enterprise software with holdings in dozens of startups.

One of the most prominent is Ant Group, which operates Alipay, China’s leading digital wallet which is value in the $10’s of billions. (And Alibaba gets 0 credit for.)

While Ant is no longer consolidated, Alibaba holds a significant minority stake and Alipay remains tightly integrated across the shopping and payment experience.

FY 2026 Q1 Earnings

Keep reading with a 7-day free trial

Subscribe to DeepValue Capital to keep reading this post and get 7 days of free access to the full post archives.